Earlier this week the embattled Greeks delivered still more body blows to the rotten regime of Keynesian central banking and the crony capitalist bailout state to which it is conjoined. By defaulting on its IMF loan, walking away from the troika bailout program and taking control of its insolvent domestic banking system, Alexis Tsipras and his band of political outlaws have shattered a giant illusion.

Namely, that the world’s debt serfs will endlessly and meekly acquiesce to whatever onerous, eleventh hour arrangements might be concocted by their official paymasters——even when these expedients are for no more noble or sustainable purpose than to forestall a Monday moring hissy fit among the gamblers in the world’s financial casinos.

So at midnight on June 30 the proverbial can was not kicked again as scheduled. Instead, Greek democracy kicked back. And it is to be hoped that the end result will be a mighty boot to the tyranny of the status quo in the form of a resounding “no” vote on Sunday.

The latter would clarify that everything at issue between the parties is false. There is no way to pay Greece’s debts, modify the troika austerity plan, save the euro, rescue Greece’ banking system or stabilize Europe’s hideously mispriced and distorted debt markets.

Its all going to blow and it should. The entire European mess has been concocted by statist politicians and policy apparatchiks who falsely and arrogantly believe they can defy the laws of markets, sound money and fiscal rectitude indefinitely.

The truth lost in all the meaningless “puts and takes” of the latest negotiations is that the Greek state was bankrupt five years ago; it can not reform, save, skimp, or grow its way out of its crushing debt, and should stop looking for ways to accommodate its paymasters. It urgently needs to default massively and decisively, and is in a ideal position to do so.

That’s because the clowns who run the troika have taken themselves hostage. That is, they have shifted virtually the entirety of Greece’s unpayable debts from private banks and bond funds to the taxpayers of Europe, the US, Japan and even the unwary citizens of Peru, Senegal and Bangladesh.

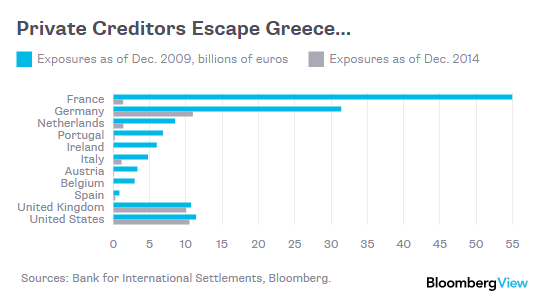

Here is the debt in 2009–mostly owed to private banks and bondholders—compared to Greece negligible private external debt today. In the case of the French, German, Dutch and Italian banks and other private lenders, for example, outstandings have been cut from $100 billion in 2009 to barely $15 billion today.

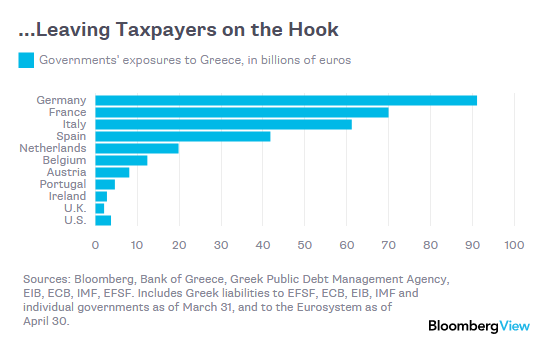

By contrast, here is the pea under which Greece’s massive debt is hiding today. Namely, almost all of it has been shifted onto the backs of the taxpayers of these Eurozone nations.

Moreover, as the New York Times noted with respect to this massive shift, the most aggressive punters have made a killing. One of them noted quite explicitly that when hedge funds started buying Greek government bonds in 2012:

“People made their careers on that trade,” Mr. Linatsas said.”

Indeed they did. And now taxpayers around the planet have been stuck with the due bill. Specifically, $250 billion or nearly 80% of Greece’s $320 billion of fiscal debt is directly owed to the EU facilities and the IMF; and upwards of half of the balance is indirectly owed to European taxpayers because $45 billion of Greece’s T-bills and bonds are either owned or funded by the ECB.

If Tsipras were not so badly advised by his pro-euro Keynesian advisors like Varoufakis, he would realize that there is no point in negotiating with the troika at all because Greek concessions can not possibly lead to the only two things that count. That is, meaningful debt relief or reentry into world bond markets.

In fact, the sole reason for compromising—nay capitulating—-is to keep the euro, and that is a snare and a delusion.

Accordingly, a clean default on this massive burden of official debt is in order for two reasons. First, Greece’s government never asked for the giant bailouts of 2010 and 2012 which transferred their onerous debts to the world’s taxpayers. The $250 billion outstanding was forced upon them by Brussels and IMF officialdom in order to protect the German, French, Dutch, Italian and other banks; and to insure that when the markets opened on innumerable Monday mornings, there would be no inconvenient turmoil on the stock exchanges or in the bond pits.

Secondly, the troika cannot give honest debt relief anyway. That’s because officialdom is now petrified of their own taxpayers—-whom they have betrayed and baldly lied to from the very beginning. Thus, the IMF has now loaned Greece $35 billion in gross violation of its own credit standards and long-standing rules. Were it ever to take the huge write-offs that are objectively warranted by the actual facts of Greece’s economic and fiscal situation, it would be eaten alive in the legislative chambers of its member governments.

Indeed, in the case of the $6 billion share of the loss attributable to the US quota, the Republican congress would have a field day investigating the incompetence and misdirection underlying the IMF’s role in the Greek bailout. The IMF would never again achieve a congressional majority for a subscription funding increase—effectively putting it out of business.

And that’s nothing compared to the political explosion that would be unleashed in the national parliaments of the Eurozone itself—– were proper debt relief to be granted. As shown below, the Germans are on the hook for $56 billion of the direct fiscal debt, but that’s not the whole of it by any means. Through the backdoor of the ECB, German taxpayers have also loaned Greece another $36 billion in the guise of liquefying the collateral of the Greek banking system.

“Liquefying” my eye!

The Greek banking system is hopelessly insolvent; the so-called “Eurosystem” obligations shown below are nothing more than fiscal transfers. Accordingly, what the clueless Angela Merkel actually accomplished during five years of weekend Gong Shows was to bury her taxpayers under $92 billion of liabilities—–nearly all of which are off-budget and unacknowledged.

Her desperate and mindless temporizing in order to remain in power thus constitutes a monumental political lie and betrayal. Were this to be exposed by a major write-down of the Greek debt,it would lead to an instant fall of her government.

The same is true for the rest of the Eurozone—only the facts are even more egregious.

France’s share of the fiscal debt is $42 billion and its total obligation including the ECB exposure is $70 billion. But France has not had a balanced budget in 40 years; is suffering from record unemployment and a decaying economy that has been suffocated by socialist taxes and regulatory dirigisme; and will soon join the triple digit club on its public debt. Accordingly, its government is petrified by even mention of Greek debt relief.

Then you have Italy buried under a 130% debt-to-GDP ratio and an economy that is 10% smaller in real terms than it was 7 years ago. So it is not surprising that its paralyzed, caretaker government does not wish to contemplate even the prospect of a write-down on the $37 billion of fiscal debt owed by Greece or the $60 billion of total exposure.

Then there is the crook and fiscal phony running Spain. No wonder Mr.Rajoy has practically threatened to take out a contract on Alexis Tsipras’ life. Spain’s economy is still grinding away 15% below its boom time peak and its government is faking its fiscal accounts to a fare-the-well. Still, its public debt continues to rise toward 100% of GDP.

So its cowardly government would rather consign the Greek people to permanent depression and debt servitude than own up to the $42 billion it has loaned the Greek state and banking system in order to keep the European banks and bond funds afloat.

Source: @FGoria

After generations of fiscal profligacy the Greek government should not worry about re-entering the capital markets at any time soon. It should resign itself to running primary budget surpluses for the indefinite future based on whatever domestic political consensus it can cobble together on the matter of taxation, pension reform, divestiture of state assets and weaning its crony capitalist leeches and special interest groups from their stranglehold on the Greek state’s depleted coffers.

Under such an all-Greek fiscal regime, it need not worry about its $250 billion of official fiscal debt or even the $130 billion of Euro-system obligations. Here’s why.

None of the governments which foisted these obligations on Greece will survive a blanket default. The more likely scenario is that the successor governments—–almost certain to be anti-EU—- will disavow the guarantees undertaken by the EFSF and demand haircuts from the underlying bank and bond holder claimants. Stated differently, a Greek default on its $150 billion of EFSF funding would trigger a domino effect back to the status quo ante.

In any event, the only alternative to this sequential chain of defaults or punishment of Eurozone taxpayers is to send in the German and French armies. But unlike the Ruhr in 1923, there are no coal mines, steel mills or other significant industrial assets in Greece to occupy. The geniuses at the troika have essentially made massive unsecured loans that are uncollectible—–proof positive that, among other things, governments shouldn’t be in the banking business.

So if Syriza gets its “no” mandate Sunday and if meaningful debt relief is impossible, what is it exactly that it would negotiate for from an arguably strengthened position? The conventional answer, of course, is continued ECB support for its banking system and retention of the euro. But both of these objectives are invalid, and are just gateways back into subservience to the Troika.

Since Greece is already irrevocably knee deep in capital controls it need only complete the process and nationalize the banks since they are irreparably insolvent anyway. For instance, Greece’s three largest banks with available public data—–Alpha Bank, National Bank of Greece and Eurobank Ergasias—–have upwards of $60 billion of non-performing loans, which represent nearly one-third of their total book of $180 billion. In addition, they also have $50 billion of bonds and other investments—much of which was issued or guaranteed by the Greek state.

Against the massive imbedded losses in these totals, by contrast, the three banks have only $9 billion of tangible book equity excluding their worthless tax-deferred assets. In short, neither the stock or the long-term debt of these banks have any recoverable value at all.

As part of a housecleaning at these wards of the state, therefore, tens of billions of bad debts would be written off including the debt of the Greek state. And the massive $130 billion of ECB claims would be primed by the claims of domestic depositors.

To be sure, most of the deposits have already fled the Greek banking system and there is upwards of $50 billion in euro notes and coins in the billfolds and mattresses of Greek citizens and multiples of that in off-shore bank accounts. Nevertheless, under a proper state directed liquidation and clean-up of the Greek banking system, the remaining domestic depositors would be made the senior creditors of a shrunken but solvent banking system. The eurosystem’s $130 billion of claims, including the ECB’s lunatic extension of $90 billion in ELA funding to the Greek central bank, would be forced to take a deep haircut on the subordinated claims it would hold after a restructuring.

Given what needs to be done with respect to Greece’s massive fiscal debt and its insolvent banking system, why would Syriza want to make post-referendum concessions to the troika for the privilege of staying in the euro?

The short answer is that is wouldn’t and shouldn’t. After the necessary fiscal default and nationalization of the Greek banking system the euro is a club no one would want to join.

Stated differently, underlying the present fraught confrontation between Greek democracy and the troika’s financial oppression is an epochal catch-22. The sweeping debt relief on which survival of the Greek economy depends would unhinge European politics, discredit the so-called European project and shatter the flawed and unsustainable money printing regime underlying the euro.

Indeed, if the Greeks do not waver after a successful rejection of the status quo on Sunday they will not need to feel lonesome about returning to the Drachma. The Italian lira, Spanish peseta, Portuguese escudo, the French franc and countless more will be back in short order.

Think of that. The IMF out of business. Merkel and Brussels gone. The Bundesbank and D-mark restored. The Keynesian money printers discredited. The front-runners and speculators in the casino carried out on their shields.