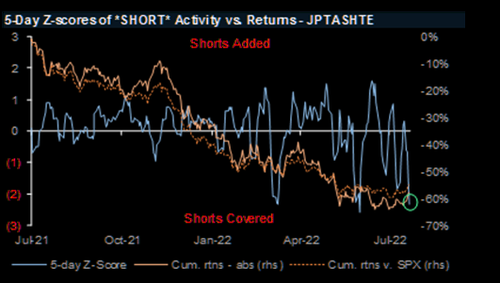

The “Most Hated Rally”

- A rollback of Chinese tariffs are around the corner. Here (good for KWEB, bad for FXI). FXI has a +25% weight to financials which are about to be demolished and heavily regulated. Easy pair trade.

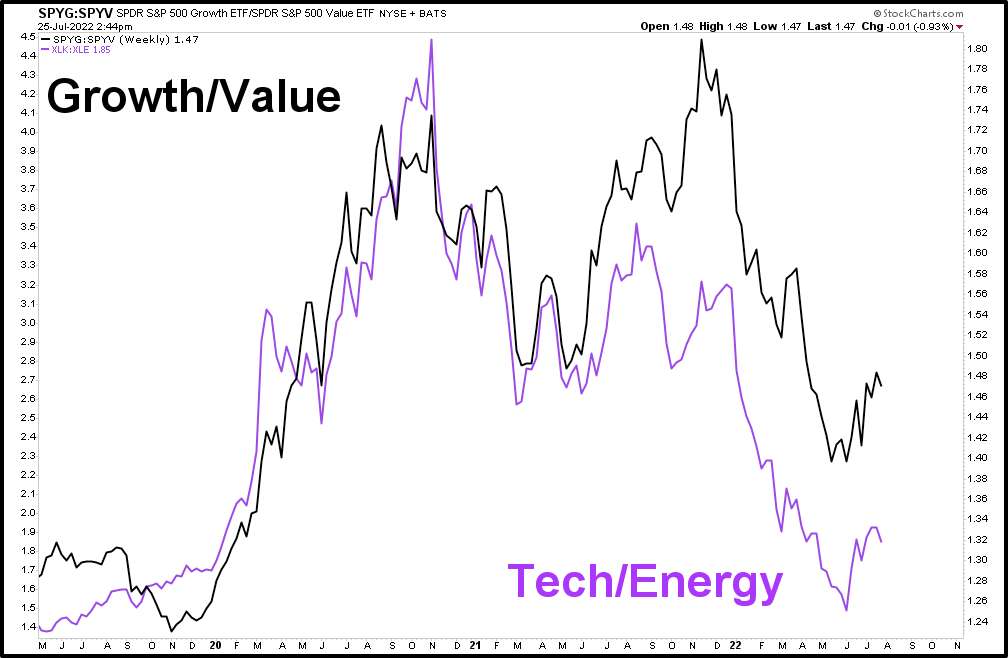

- Energy vs QQQ is back. Expect a bounce back in energy for the week.

- USD weakness helps bid energy, which will also help raise interest rates

- The European Center Bank’s First Rate Hike In 11 Years. They are already expecting policy mistakes. Wait for an entire EU country to go under before acting.

- A whistleblower says Google’s AI bot is sentient. The transcript is wild. Here

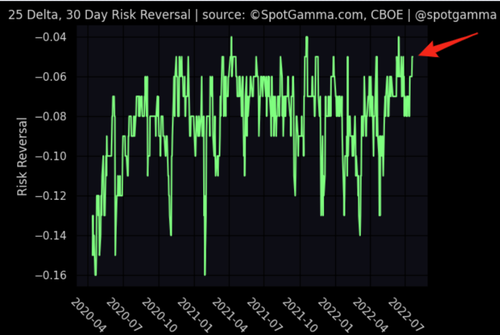

- Call vols and skews are very firm as there is growing sense that this rally is different and might be able to continue.

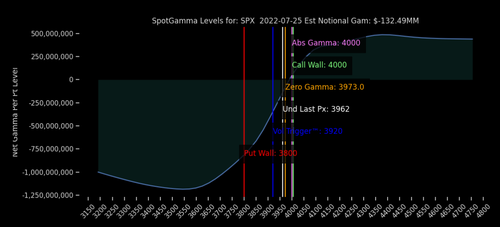

- Back in June when the S&P was 3750 we noted that 4000 was not consensus but certainly possible.

- This rally can persist and investors will hate it.

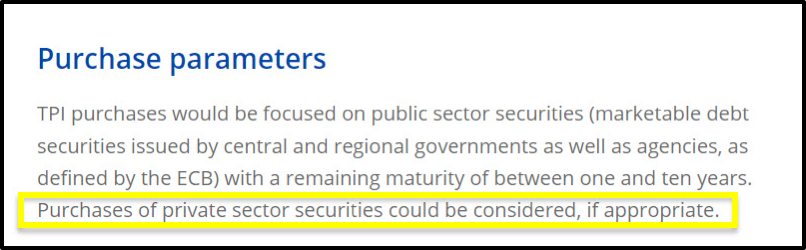

The ECB will step in and buy ETFs if it needs to during this rate hike. This is BIG. Source Here

KWEB is still outperforming

Expect a weaker US Dollar and a 1.05 Euro

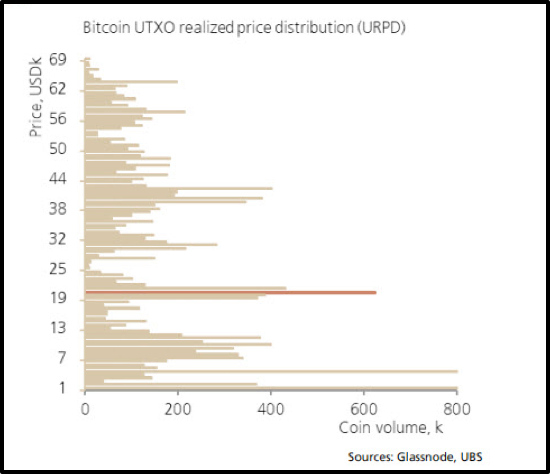

The only Bitcoin chart that you need.

Expect this +10% spread to tighten.

Energy was dragging yields down with it but expect a bounce-back this week after being extremely oversold.

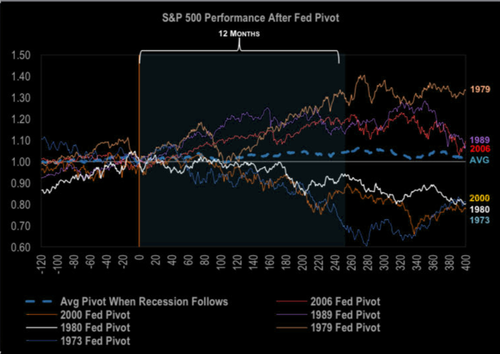

The FED Just Crushed Demand. Better now than later.

Gasoline Build Also Signaling Demand Destruction

Rules To Remember:

Return Always wants its risk payment.

Trading one asset class is trading blind.

Fundamentals were always just a narrative.

Price action matters most.

NEVER MISS THE NEWS THAT MATTERS MOST