Even the most market-oriented capitalist would hesitate to encourage Lockheed Martin, Raytheon, or Boeing to produce more sophisticated weapons systems for other nations than we produce for ourselves, even if it meant huge profits for those companies and their shareholders. It would simply not be in our national security interest.

Yet few voices are raised when America’s leading investment banks secretly encourage foreign governments, such as those in Greece and Spain, to manipulate their national budgets to conceal real deficits; and then those banks receive huge profits for doing so. The net result is to destabilize international financial systems and cause markets to fall, including in the United States.

Something is wrong here. Are investment banks chartered in the U.S. free to make profits that are distinctly not in the interest of the U.S. and dismiss their counter-productive manipulations in the name of “free markets”? Apparently the answer is yes. If the guardians of our country’s economic interests, such as Mr. Geithner or Mr. Summers, have spoken out to condemn this activity, then they have done so quietly. These are the same banks that became “too big to fail” and thus demanded, and received, bailouts from the U.S. taxpayers even while piling up continuing huge bonuses.

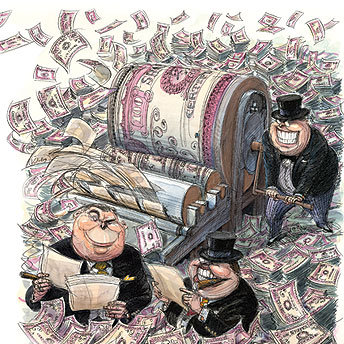

Something is definitely wrong here. In an increasingly integrated, globalized financial world, it is wrong for private American financial institutions to go abroad selling financial snake oil to foreign governments knowing their practices to be shady at best and crooked at worst, take their gigantic fees, flee back to New York, and count their ill-gotten gains in the Hamptons while workers in Greece, and in the United States, suffer the consequences.

This is not only wrong. In a just world it would also be criminal.

Markets are wonderful mechanisms, but only up to a point. Greed is not self-correcting. The lessons of corruption never seem to be learned beyond a generation or two. After a cycle of manipulation and corruption, reforms and regulations are enacted. But then everyday Americans forget the lessons, vote for politicians preaching “free markets” and “deregulation” and the cycle repeats itself. Deregulation was the watchword during the Clinton and Bush years. And see what it gave us. Bernie Madoff. Who stole billions while the Securities and Exchange Commission turned a blind, deregulated eye?

Even if you believe private investment banks should be free to loot and plunder here in the United States, do you also really believe they should be free to do so around the world? And do you also truly believe this is in the national security interest of the United States? If so, there are some clever people who have some credit default swaps they wish to sell you.

To comment, please visit Senator Hart’s blog at www.mattersofprinciple.com/.