THE GOLD PROBLEM REVISTED

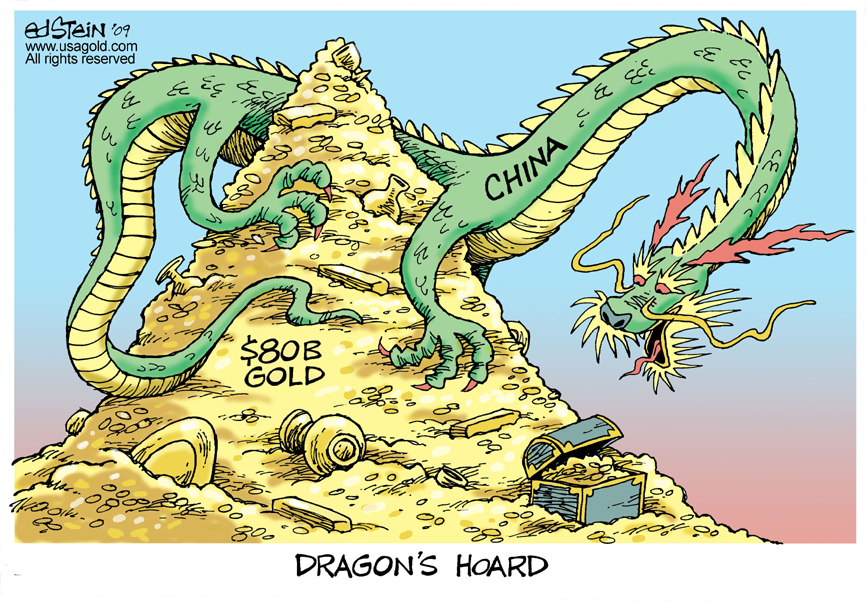

Watch for special report soon to publish here on China`s Cornering The Gold Markets

Watch for special report soon to publish here on China`s Cornering The Gold Markets

Yesterday, Ben Bernanke dedicated his entire first propaganda lecture to college student to the bashing of the gold standard. Of course, he has his prerogatives: he has to validate a crumbling monetary system and the legitimacy of the Fed, first to schoolchildrden and then to soon to be college grads encumbered in massive amounts of non-dischargeable student loans. While it is decidedly arguable that the gold standard may or may not have led to the first Great Depression, there is no debate at all that it was sheer modern monetary insanity and bubble blowing that brought us to the verge of collapse in the Second Great Depression in 2008, which had nothing to do with the gold standard. And as usual there is always an other side to the story. Presenting that here today, is Antal Fekete with “The Gold Problem Revisited.”

THE GOLD PROBLEM REVISITED

Antal E. Fekete

The article The Gold Problem of Ludwig von Mises, published 47 years ago in 1965, just six years before he died (the gold standard died with him in the same year) has some breath-taking thoughts, for example, “the gold standard alone can make the determination of money’s purchasing power independent of the ambitions and machinations of governments, of dictators, of political parties, and of pressure groups”, or: “the gold standard did not fail: governments deliberately sabotaged it, and still go on sabotaging it.” But for all our admiration we would be amiss if we did not point out certain errors in his article. These are all errors of omission, and correcting them would hopefully make the Mises article even more helpful to the discriminating reader.

Mises fails to answer his own question why gold is the best choice to serve as money. Indeed, why not another commodity, or a basket of commodities? The reason is that the marginal utility of gold is unique in that it declines at a rate slower than that of any other substance on Earth. Various assets have various marginal utilities which determine their value. All of them decline, albeit at various rates. In other words, economic actors accumulate assets increasingly reluctantly, up to their satiation point that will be reached sooner or later. For gold, this point is removed farther, so far indeed that for all practical purposes it is beyond reach.

Therefore if you substituted another commodity, or basket of commodities for gold, then you would end up with a unit of value the marginal utility of which was inferior. It would decline at a rate faster than that of gold. It would be akin to substituting a yardstick made of rubber for one made of metal.

1. The futility of inflationary policies

Mises ignores the fact that newly created money can be spent not only on goods and services, but also on financial assets. This is the proverbial fly in the ointment of the inflationary argument. It is also a subtle one, so much so that the government as the would-be perpetrator of inflation often falls victim to it. It may think that it is promoting inflation while, in fact, it acts as quartermaster for deflation.

By restricting the circulation of gold money or by other means, the government can make financial speculation more attractive. In doing so it wants to reduce the amount of money available for buying goods and services. This strategy of the government and its pseudo-economists consists precisely in channeling enough of the newly created money into speculative ventures so that the untoward consequences of price and wage rises will not occur, or they will occur later, so that the causality relation is obscured.

The paramount example is bond speculation. Of course, under the gold standard there is no bond speculation because the variation in the bond price (or, equivalently, in the rate of interest) is minuscule making the opportunity to earn speculative profits negligible. Unless… unless… the central bank makes profits risk free as a bait to speculators by inappropriate monetary and fiscal measures. This is exactly what happened in the early 1920’s when the policy of open market operations, so called, of the Fed were first introduced quite illegally, we might add (the policy was legalized retroactively in 1935).

As the Fed was originally constituted, it was only enabled to be a passive partner in business. Limited by its charter the Federal Reserve Act of 1913, it could enter (or decline to enter) business initiated by others, but it could not initiate business on its own. It could post its rediscount rate, but member banks had step forward to request rediscounting real bills from their portfolio. In and of itself rediscounting was not inflationary as a way to create new money. The new purchasing power so created was backed, dollar for dollar, by salable merchandise arising in production, and it was to be extinguished when the merchandise was sold to the ultimate consumer at the time the bill matured.

This was not the case, however, when the Fed assumed an active role and started purchasing government bonds in the open market at its own initiative in contravention of the Federal Reserve Act of 1913. The monetary base was enlarged. This provided a direct incentive for member banks to make loans regardless whether or not new merchandise was simultaneously emerging in production. Using standard Quantity Theory of Money (QTM) reasoning the Fed and everybody else assumed that the effect would be inflationary. Hooray, a subtle and potent new way of inflating the money supply has been invented! The economy can now be micromanaged at will! There was jubilation in the inflationist camp.

The jubilation was premature. The policy of open market operation as an instrument of inflation was an enormous blunder. QTM was inoperative: bond speculators overrode it. They knew when the Fed had to go to the open market to relieve ‘natures urge’ (to purchase its next quota of government bonds). Speculators could make risk-free profits by pre-empting the Fed in buying the bonds first. The ‘tool’ of baiting speculators with risk free profits backfired badly, if only for the reason that speculators were a much smarter lot than central bank agents facing them in the bond pit. They risked their own capital while losses made by central bank agents were covered from public funds. The game plan was upset. What was supposed to be inflation ended up as deflation. Here are the details.

In an unhampered market risk-free profits that may occur from time to time are ephemeral and therefore inconsequential. Hawk-eyed speculators immediately take advantage of them with the result that any further opportunity to make risk-free profits is eliminated on the spot. This is no longer true if the opportunity to make risk-free profit is not an infrequent aberration but the consequence of deliberate and well-advertised official policy as it is in the case of the policy of open market operations. When the central bank relies on open market purchases of government bonds in order to augment the monetary base on a regular, ongoing basis, then speculators can anticipate and pre-empt it. This policy, whole-heartedly supported by Keynesian/Friedmanite economics, is the most ill-conceived monetary policy ever concocted for the purpose of increasing the stock of money. The Federal Reserve Act of 1913, for excellent reasons, disallowed such a policy and imposed stiff and progressive penalties for non-compliance on the Federal Reserve banks if their balance sheet showed that government bonds had been used to cover Federal Reserve note or deposit liabilities. At first the Fed used open market operations illegally. It could get away with it because of the connivance of the Treasury in ‘forgetting’ to collect the penalty. The conspiracy created a fait accompli and, in the end, Congress was forced to legalize the corrosive practice retroactively in 1935 when it amended the Federal Reserve Act.

The newly invented monetary policy of open market operations is responsible for much of the deflationary damage inflicted on the world economy during the Great Depression of the 1930’s. It started an avalanche of falling interest rates that soon went out of control. Falling interest rates destroy capital as they increase the burden of debt contracted earlier at higher rates. Perfectly sound businesses fail if their debt burden, through no fault of theirs, exceeds the profitability of deployed capital. The whole process was most insidious. Entrepreneurs did not know what hit them. From one day to the next they found themselves uncompetitive as competitors financed their business at lower rates. They had to lay off their employees. They went bankrupt in droves. Wanton destruction of capital was the main cause of deflation and the Great Depression in the 1930’s.

Herein lies the incredible failure of the policy of open market operations, missed by Mises. The policy is counterproductive from the point of view of central bank and pseudo-economists acting as its cheer-leaders. It released the genie of risk-free bond speculation from the bottle in the hope that it could always be put back. But it could not. Falling interest rates would run their devastating course.

The same thing repeats itself today. Interest rates have been falling for over thirty years. The Fed is no longer in control. It is lunacy to believe that it can stop the avalanche that it started so easily in the early 1980’s. Today the speculators are the only buyers after China and other exporters to the US bailed out of the US T-bond market. Speculators will keep buying the bonds as long as they can reap risk free profits. It is true that ‘quantitative easing’ cuts into that business, as the Fed is buying bonds directly from the Treasury, bypassing the open market (another illegal practice). Watch for the day when the speculators will start dumping bonds and selling them short. When they transfer their buying from the bond market to the commodity market, the game is up.

Open market operations is a charade that can go on only so long as speculators are allowed to reap risk-free profits at the expense of the producers and the savers. When the latter have been squeezed dry, it’s “après nous le deluge”. That is the true scenario of Great Depression II.

2. The futility of the policy of suppressing interest rates.

The rate of interest is a market phenomenon just like prices. In fact, the definition of the rate of interest must refer to the bond price: it is the rate that amortizes the price of the bond as quoted in the secondary market through the bond’s maturity date. The floor for the range in which the interest rate may move is determined by marginal time preference. (The ceiling, on the other hand, is determined by the marginal productivity of capital.) To understand this, we must consider the arbitrage of the marginal bondholder between the bond market and the gold market. If the rate of interest falls below the rate of marginal time preference, then the marginal bondholder sells his overpriced bond and keeps the proceeds in gold coin. In this way he can force the bond price to come back to earth from outer space. Bank reserves are shrinking and the banks have to call in some of their credits and sell bonds from portfolio. When the bond price falls, the marginal bondholder repurchases his bond at a cheaper price. Time preference has no meaning outside of this context. It will remain a pious wish ? until the marginal bondholder gives it teeth.

Mises (and, before him, Ricardo who was an advocate of the elimination of gold coins from circulation) was wrong when he stated that there is no difference between the gold coin and a promise to pay gold coin as long as the security and maturity of the promise cannot be doubted. The promise can perform all the monetary functions that the gold coin does. Well, it cannot, because there is one very important exception. When the marginal bondholder in protest to low interest rates sells his bond (a future good), he insists on getting gold (a present good). He will not take a promise to pay gold, because it is still a future good, and an inferior one to boot as it pays no interest. Taking it would mean jumping from the frying pan into the fire. This shows that gold hoarding, far from being a deus ex machina, and far from being a curse of the gold standard, is an important market signal. It indicates that the rate of interest is being pushed below the rate of marginal time preference. It had better be heeded before it is too late. Gold hoarding cannot be understood except in the context of its counterpart, gold dishoarding. When the signal is heeded, banks tighten up their loose credit policies and the government reins in expenditures, gold will be dishoarded and the marginal bondholder will replace gold in his portfolio by repurchasing the bond at a profit.

This was the reason for eliminating gold coin circulation first in Europe in 1914, and then in the United States and Canada in the 1930’s. Governments wanted to make sure that they were in full control of the rate of interest, free from any interference from the marginal bondholder. This policy had to fail. It was shipwrecked on the reef of gold hoarding.

All economists, including Mises himself, missed the importance of the nexus of gold hoarding and dishoarding as the manifestation of arbitrage by the marginal bondholder between the bond market and the gold market, explaining the all-important contact between gold and interest.

3. The futility of the policy of boosting wages.

Mises did not subscribe to Adam Smith’s Real Bills Doctrine (RBD). Although he acknowledged the fact that real bills drawn on consumer goods in most urgent demand could circulate as a kind of ephemeral money through endorsing, as they indeed did in Lancashire before the Bank of England opened its branch in Manchester, he did not find this matter worthy of further attention. He coined the word “circulation credit” that financed the movement of commodities from the producer to the consumer through the various phases of production, but he blotted out the important distinction between the discount rate and the rate of interest. He never used the term “self-liquidating credit”, that would have revealed why circulation credit did indeed circulate without any coercion from the government. They did circulate because the credit was liquidated by the sale of merchandise in high demand on which the bill was drawn.

Mises was unimpressed by the fact that bonds and mortgages could not circulate in the same way. He had too great a faith in the Quantity Theory of Money, and was probably disturbed by the fact that real bills, however temporarily, could serve either as money substitutes, or as bank reserves on which sound money could be built. His negative attitude with regard to Adam Smith’s RBD is regrettable. Real Bills are the next best thing to gold into which they mature in 91 days or less. The demand for real bills is virtually unlimited. Not only banks with surplus gold in their tills scramble for them as the best earning asset commercial banks can have, but also those individuals and institutions who have large payments coming up (say, the purchase of a house, or a factory, or the retirement of a bond issue) and they have to assemble cash by the closing or maturity date. They could not put these accumulating funds into stocks, bonds, or mortgages because they were not sufficiently liquid. An increased offering would immediately depress their price. Instead, these people went into the bill market and bought real bills the liquidity of which was second only to gold.

But real bills had another great significance having to do with the labor market. The only author who recognized this fact was the German economist Heinrich Rittershausen (1898-1984), see his book Arbeitslosigkeit und Kapitalbildung, Jena, 1930. A large part of outstanding real bills in circulation represented the wage fund of society. Out of this fund wages for labor producing merchandise that will not be available for sale for up to 91 days could be paid now. Thus real bills represented a real extension of demand for labor. Employers would simply go ahead and hire all the hands needed to produce merchandise in high consumer demand, without worrying who will advance the funds to pay wages before the merchandise could be sold. The wage fund would always be there. The RBD explains why there was no ‘structural unemployment’ in the 19th century, in contrast with the 20th when the wage fund was destroyed never to be rebuilt. 19th century entrepreneurs did not have to assume the burden of financing the payment of wages. The bill market took care of that. Say’s Law was operative: there were employment opportunities as long as prospective employees wanted to eat, get clad, shod, and keep themselves warm in winter.

The point was driven home most forcefully when the wage fund was inadvertently destroyed by the victorious Entente Powers. They decided not to allow the rehabilitation of the bill market after the cessation of hostilities in 1918. This single decision sealed the fate of tens of millions of workers who were to be laid off in the 1930’s for lack of financing the wage bill. It was also the reason for creating the corrosive ‘welfare’ state that paid workers for not working and farmers for not farming. It also caused the demise of the gold standard by removing a vital organ, its clearing house: the bill market. Here are the details.

The victorious Entente Powers were afraid of German competition in the postwar period. They wanted to monitor, if not control, Germany’s exports and imports. As this would not be possible under the system of multilateral trade, that is, trade financed by real bills circulation, they opted for a system of bilateral trade. Never mind that this meant a setback for their own producers and consumers as well. Never mind that much more gold was needed to run a system of bilateral trade than that required by a system of multilateral trade extra gold they did not have. Never mind that this would make the 1925 return of Britain to the gold standard deflationary. The neurotic fear of German competition took precedence over all other concerns. In fact, these concerns were never examined and the decision was made in high secrecy.

This was the end of real-bill financed world trade, the great success story of the 19th century. The bill market was destroyed. We still suffer the consequences. In effect, world trade was reduced to barter. Worse still, along with the destruction of the bill market society’s wage fund was also destroyed. There was no one to advance wages payable to laborers whose products could not be sold for cash up to 91 days. Vast sections of the world’s productive plants were condemned to idleness for the disappearance of the wage fund. As I mentioned, the only economist in the world who saw what was coming was Rittershausen. Economists still owe him recognition for his great insight. The world is still condemning the gold standard as the major cause of the Great Depression of the 1930’s and the horrible unemployment in its wake, when the real cause was the destruction of the wage fund, a misguided unilateral decision of the victors in World War I made in secrecy.

It was most unfortunate for economic science that Mises failed to put the weight of his reputation behind Rittershausen’s charge. Not only had governments put improper and counterproductive measures into effect to boost wage rates, thus fostering unemployment. They were directly responsible for the world-wide leap-tide of unemployment by destroying the bill market and the wage fund.

Once again the world is facing the same dangers as it did four score of years ago. Yet one can see only complacent governments in a self-congratulating mood over their ‘success’ in ‘fending off’ the Great Financial Crisis. But the writing is on the wall: if governments fail to rehabilitate the gold standard and its clearing house, the bill market, together with the wage fund, then a much more devastating leap-tide may soon engulf the world.

4. The futility of the policy of gold valorization.

The world has been witnessing the pathetic attempts of governments and central banks “to keep the gold price in check” since the 1971 fraudulent default of the US government on its international gold obligations. To be sure, a default is always followed by a depreciation of the dishonored paper, so the futility of the policy of gold valorization has always been a foregone conclusion. But what we have is far more than this self-defeating effort to keep gold out forever from the monetary system. What we have is a veritable brain-washing of the whole world about the role of gold in the economy, and blaming gold for results that only keeping gold in the system could have prevented.

It is alleged that gold has disqualified itself from playing the role as the monetary anchor and source of credit in the economy. ‘Gold is far too volatile for that’. This is puerile because it ignores the fact that the so-called volatility of gold is just the mirror image of the volatility of the irredeemable dollar in which the price of gold is quoted.

It is also ignored that the debt crisis is a direct consequence of exiling gold from the international monetary system. Gold is the only ultimate extinguisher of debt. It cannot be replaced by the dollar or any other irredeemable currency. Under the dollar system debt simply cannot be extinguished. Total debt can only grow, never shrink. All the bad debt and “toxic sludge” stays in the system and is merely kicked upstairs into the balance sheet of the US Treasury. There it remains, representing a great threat to the world. Like radioactive material, when its quantity exceeds the threshold, a chain-reaction starts triggering an nuclear explosion. The world needs gold as a safe way to eliminate bad debt.

Through a system of bribes, blackmail and intimidation research on questions relating to gold has been discouraged to the point that it is practically non-existent. The world continues to live in a fool’s paradise. It believes the size of government debt does not matter because it can always be rolled over. Nor would it cause inflation or deflation because competent and honorable gentlemen at the helm can safely navigate our monetary ship through the strait of Scylla and Charybdis. They have a sharp tool, the printing press, and with its judicious application they can fine-tune the quantity of money in circulation as well as the rate of interest for the benefit of all. But the virtual elimination of research on gold will strike back. These ‘competent’ and ‘honorable’ gentlemen at the helm are complete ignoramuses when it comes to gold. They have no notion of the erosion of the gold basis and the irresistible march of the gold futures markets into the death valley of permanent gold backwardation. When disaster strikes, gold will not be available at any price. What this means is that the world is insidiously slipping into barter. But you cannot feed the world’s present population on the basis of a barter economy. Poverty, pestilence, famine threatens society, not to mention the breakdown of law and order. All this, and more, because government leaders have allowed the suppression not only of monetary gold itself, but also the research on monetary gold.

Ben Bernanke, the Chairman of the Federal Reserve Board introduced a new phrase into the vocabulary of economics on July 11, 2011, in his testimony at a Congressional hearing. The new phrase is: tail risk. He defined it as the “really, really bad outcomes” in the economy, as if they were completely outside of human control on the pattern of floods, earthquakes, volcanic eruptions and tsunamis.

But ‘tail risk’ in reality is the wholly unnecessary risk taken with human lives by a parasitic, contemptuous, conceited, and yes, ignorant ruling class symbolized by Bernanke, that has hijacked the Constitution, in particular, turning the Constitution’s monetary provisions upside down which define money in terms of gold and silver. They are only interested in their own self-aggrandizement, in perpetuating their power, and in preserving their superstitious faith in irredeemable currency a monetary system that has failed miserably every time foolish leaders in history experimented with it.

Mises was a great warrior fighting these usurpers and monetary hijackers with the sharpest weapon there is: human reason. We must follow his lead even if it sometimes means that we have to add new ideas that go beyond Mises’s opus.

The day of reckoning for monetary insanity is on hand. The Constitution is there for the protection of all. If we fail to preserve and uphold it, and meekly succumb to the monetary hijackers’ and usurpers’ tactics, then we shall have only ourselves to blame for the consequences.

March 20, 2012.

Editors Note: If you made it too the bottom of this page, congratulations, as such Here is a free link on where to buy the cheapest gold coins anywhere in the world,,,,,