Whatever The Guardian is, just like The New York Times, The Washington Post, CNN, MSNBC, NPR, and the rest of the Western presstitutes, journalism is not present on its pages. What the West has is a Ministry of Propaganda. The public is lied to and brainwashed, not informed.

We can see the total failure of The Guardian, and all the rest as well, in the reporting on the arrest of the alleged Russian spy, Maria Butina by the utterly corrupt US Department of Justice (sic). The principal evidence against Maria is that she met with a former Russian ambassador to the US, Sergey Kislyak. According to the utterly corrput US Department of Justice (sic), an assistant US attorney, Erik Kenerson, “cited Butina’s encounter with Kislyak as proof that she was in touch with diplomatic or consular officials and must be detained while awaiting trial.”

So, in America if you get your photo taken with a former Russian ambassador to the US it is evidence that you are a spy.

I have read the indictment of Maria Butina. She is not accused of any crime recognizable by Anglo-American law. She is indicted under Jeremy Bentham’s 18th century totalitarian argument that she is guilty of the “crime” of possibly intending to commit one in the future. (See The Tyranny of Good intentions by PCR and Lawrence Stratton.)

Deutsche Bank Crashes After Fed “Secretly” Put US Operations To “Troubled” Watchlist

It was already a terrible week for Germany’s largest bank, when the Italian turmoil sent its stock price below €10 for the first time since the bank’s existential crisis in the fall of 2016, and it just got worse this morning, following reports that the Federal Reserve has designated Deutsche Bank U.S. operations to be “troubled condition” which the WSJ said was a rare censure for a major financial institution and is being reflected in its price this morning, which is now down over 5%, at €9.35, and rapidly approaching the all time low of €8.834 hit in September 2016 when speculation was rife that Germany would bail out Europe’s largest lender.

As the WSJ reports, the Fed’s downgrade took place secretly about a year ago, and until today hasn’t been previously made public.

The “troubled condition” status—one of the lowest designations employed by the Fed—has influenced moves by the bank to reduce risk-taking in areas like trading and lending to customers.

Some additional details on the Fed’s secret rating system known as “CAMELS”

The U.S. system for rating banks is called “CAMELS,” which stands for capital adequacy, asset quality, management, earnings, liquidity, and sensitivity to market risk. A bank’s topline rating, from 1 to 5, takes into account all those categories. The best rating is “1.” Troubled banks are rated either “4” or “5.” Scores aren’t made public.

While hardly a surprise for the recidivist criminal bank, the Fed’s special designation means the bank has had to clear decisions about hiring and firing senior U.S. managers with Fed overseers. Even reassigning job duties and making severance payments for certain employees require Fed approval, the WSJ sources said.

This unprecedented scrutiny of DB by the Fed, which comes at a time of great turmoil for the bank whose CEO was recently expelled and which has seen many of its top traders and bankers quietly quit or get poached, has rippled through Deutsche Bank’s relationships with other regulators, including the FDIC., which has pressured the lender to improve controls and oversight.

The Fed downgrade also landed the bank’s FDIC-insured subsidiary, Deutsche Bank Trust Company Americas, on the FDIC’s “Problem Banks” list of at-risk institutions.

The FDIC doesn’t detail the membership of the list, but does say how many banks are on it and the combined value of their assets. The list’s asset total rose by $42.5 billion in the first quarter; Deutsche Bank Trust Company Americas, the bank’s well-capitalized American deposit-taking unit, had $42.1 billion in assets as of March 31, according to regulatory filings.

Deutsche Bank To Fire 10,000 Employees: 1 In Every 10

Well that escalated fast: one month after Bloomberg reported that Deutsche Bank would cut 1,000 jobs in the US, roughly 10% of its total US labor force, as part of new CEO Christian Sewing’s restructuring process, the WSJ this morning writes that executives at the biggest German lender have “zeroed in” on plans to eliminate close to 10,000 jobs, about one in 10 employees, as part of the bank’s epic cost-cutting scramble.

The latest plan, part of a process that has divided senior executives and left investors unconvinced, “would extend into 2019, follows months of thorny debate over how fast and deep job losses should be at the beleaguered German lender.”

So far investors remain unconvinced the plan will work, and as a result the bank’s shares have fallen by nearly a third this year, making DB stock one of the worst performing European stocks, and at its lowest since a crisis of confidence hit the bank in late 2016.

Meanwhile, high-level clashes over staffing and budgets and conflicting opinions from outside investors and bank executives reveal the depth of Deutsche Bank’s continuing struggles. As the WSJ adds, the bank’s supervisory board and senior executives will confront investors Thursday in Frankfurt at its annual shareholder meeting. They will face a proposal to break up the company and probing questions about last month’s chief executive handoff and the tough choices the lender has to make.

Separately, Bloomberg report that the bank is about to “retreat from a swathe of equities markets across the world, including some on its own doorstep in Europe.”

Germany’s biggest lender, which is expected to announce a range of restructuring measures to coincide with its annual shareholder meeting Thursday, will sharply reduce its presence in the U.S. market, and has also started cutting activity in the Central Europe, Middle East and Africa region, the people said, asking not to be identified discussing private information.

In case it wasn’t clear, it has been a messy year for Deutsche Bank. The April 8 ouster of CEO John Cryan in the middle of his management contract shook employees and appeared botched to some clients and investors.

Things could get messier on Thursday, when Deutsche Bank’s chairman, Paul Achleitner, will face a vote of no-confidence, which could thrust Germany’s biggest bank into outright crisis after years of underperformance and strategic flip-flops.

The shareholder meeting will convene as Deutsche struggles to convince investors that it has a credible strategy, under the leadership of chairman Paul Achleitner and Christian Sewing, the new chief executive he appointed in chaotic circumstances last month.

Among the potential names to replace Achleitner is Philipp Hildebrand, the former chief of the Swiss central bank, who currently heads Blackrock’s business in Europe. He quit the SNB after his wife was embroiled in a major FX insider trading scandal. In other words, Hildebrand should fit right into the “culture” at Deutsche Bank.

The U.S. Dollar just had one of its biggest rallies in decades.

Between 2014 -2016, the Dollar soared 29%. This was because the Fed finally ended QE3 (their last round of money printing) and began talking about raising interest rates. This was their tightening cycle.

During this time, U.S. economic growth was in a downtrend. Not too mention the Fed couldn’t get their ‘healthy’ 2% inflation.

But at the beginning of 2017, the Dollar entered a bear market – falling over 12% in 15 months.

Yet in this period, U.S. growth was in an uptrend and inflation finally eclipsed 2%.

Take a look for yourself. . .

Secondly. . .

One of my favorite financial minds is Russel Napier. He wrote ‘The Anatomy of a Bear’ and it’s one of my favorite books (this book is in our must-read list).

It’s about the harshest bear markets over the last 100 years. It’s insightful and interesting to see how things got that bad after being so good.

To put it simply, this guy knows bear markets.

He recently hypothesized that the U.S. Dollar will keep rallying higher. And this will trigger the next systemic banking crisis and lower growth.

A stronger dollar is also negative for global stocks. And emerging markets could ‘blow up’ because of their debt ballooning.

I agree with Napier on this – except that this reality won’t happen.

If there is any sign of slowing growth or a systemic banking crisis, the Fed will reverse their hawkish tone and (inevitably) restart their printing presses.

Therefore, the recent Dollar rise won’t last. It can’t last for growth’s-sake.

We can deduct from Trump’s words and by looking at the strengthening GDP that a weaker Dollar is what the U.S. really wants.

Once investors perceptions realize this reality – the Dollar bear market will resume.

And the Reflexivity feedback loop that recently lifted the dollar up will against it – all the way down.

Ultimate Indicator Shows US Never Recovered From The ’08 Great Financial Crisis

Authored by Chris Hamilton via Econimica blog,

The ultimate indicator of personal economic confidence is the determination to perpetuate the species and have children. The chart below shows annual US births from 1910 through 2017 and it is estimated there were 3.84 million births in 2017, nearly a hundred thousand fewer than in 2016.

The 2017 figure is also nearly a half million fewer than the late 1950’s baby boom era peak and likewise below the subsequent mid 2000’s double peak. The 2017 figure is also nearly six hundred thousand below the Census estimates provided as recently as 2000 and 2008.

To offer some perspective, the chart below shows annual births versus total US population…despite the total population nearly doubling since 1957, the US had 11% fewer children in 2017 than 1957…or 2007.

More poignantly, below is the US childbearing population (those aged 15 to 45 years old)…the red columns represent the annual change while the blue line is the total 15 to 45 year old population. As can be plainly seen, the growth of the childbearing cohort represented by the “baby boom” on the left dwarfed the growth represented by “millennials”, on the right. Of course, on a relative basis (%), the millennials represent less than a third the annual quantity of growth than the boomers offered…and millennials high levels of education driven indebtedness and poor quality of employment, etc. mean the quality of growth they represent is even lower than their numbers would indicate.

A last note regarding millennials, their estimated “growth” was never organic (as births essentially never exceeded those during the “boomer” period) and instead was almost entirely dependent on estimates of continued high rates of immigration…the same immigration that has dramatically slowed since the early 2000’s. Chart below shows the sources of 15 to 64 year old population growth (declining births vs. immigration…annual average per 5 year periods) since 1970. Given this, there is a high probability that the size of the millennials significantly undershoots estimates.

Births continue to decline since 2007 (represented by columns in the graph below) while the Census birth estimates continue to tumble (lines below represent select Census Est.’s from 2000 through 2017). The Census estimates for ’00 and ’08 (essentially identical) anticipated annual births would rise to 5.7 million by 2050 (and continue rising thereafter). However, after the ’09 GFC and ’10 Decennial Census, the Census Bureau began dramatically reducing their present and future estimates for growth. Nevertheless, each reduction was still far too optimistic.

Total births continue to surprise to the downside and significantly lower estimates are needed if the Census forecasts are going to match reality. I offer a more realistic “guesstimate” (dark blue line) based on the ongoing changes to the childbearing population and current trends. Even immigrants quickly norm to the lower fertility rates once in the nation. Simply put, the conditions for family formation and child rearing continue to deteriorate. The US isn’t alone, detailed (HERE), and the situation within the US is dire detailed (HERE), (HERE), and (HERE) but the question remains. Why are birth rates and total births declining amid a growing population and record levels of wealth?

The chart below shows the fast decelerating US fertility rate versus record Household Net Worth. The previous peaks in HHNW saw corresponding upticks in the fertility rate, but not this time.

Unfortunately, since ’07, nearly all the benefits of this record “wealth” creation are being accrued by a fraction of Americans. The federal government and Federal Reserve programs have benefited asset holders while penalizing the working class with fast rising costs of living (record rents as a % of income, record insurance, higher education costs, reduction/elimination of pensions and job related benefits, etc. etc.) absent the higher wages with which to pay for these. It appears the present and future generations opportunities are being sacrificed to maintain and further a select group in the here and now.

The chart below details the growth in household net worth by income levels from ’07 through ’16. Those that have significant assets have been further enriched…those without have been punished (and as the saying goes, “the beatings will continue until morale improves“).

The continuation of the present policies will only further grossly enrich a shrinking minority while continue to penalize those of childbearing age (among others). This will only further push the birth rate into negative territory (well below replacement level). The Fed’s inequitable cure is essentially saving the elderly patient at the expense of the present and future of the patients offspring. The merit of an economic system which results in the childbearing populace unable and/or unwilling to perpetuate the species is sorely in need of reconsideration and reconstruction.

EDITORIAL COMMENT….NOT MY JOB TO WARN PEOPLE…..

I can’t hold myself back anymore. Time and time again I see headlines from Bloomberg News, a news source I usually hold in high regard, that is blatantly and obviously trying to manipulate markets in one direction or another. In the past, I just chuckled to myself for what seems to be a sad attempt to move markets for someone’s own benefit. Do they know their attempts are that obvious that can be spotted easily? Are they doing it for internal egotistical purposes, monetary purposes or just being a puppet having stories fed to them for outside money managers?

I have been an avid Bloomberg News supporter and daily visitor to their site for over a decade. I appreciate Bloomberg News as a trusted source for articles and news usually based on statistics and raw data, avoiding biased reporting. But lately I have seen too many headlines that are blatant attempts to try to move markets in one direction or another………READ REST OF THE STORY

Russian banks ready to switch off SWIFT – official

“Certainly, it is unpleasant, as it will prove a stumbling block for companies and banks, and will slow down work. It will be inevitable to deploy some aged technologies for information transfer and calculations. However, the companies are technically and psychologically ready for the shutdown as this threat was repeatedly voiced,” Dvorkovich said, as quoted by TASS.

He added that the measure may have a negative impact on corporations working in the US and Europe.

Why Continuing Down This Path Leaves America In A No Win Scenario

Cyber Security Expert Claims “Bitcoin Created By US Govt.”

Cyber Security Firm, Kaspersky Lab, just made a shocking announcement revealing the unsettling truth about Bitcoin. And if it’s true… if Bitcoin was in fact created by the government… it could have dramatic consequences.

This odd finding – namely that the VIX ETPs had shifted their traditional vol bias from long to short – prompted the Goldman strategist to ask glibly “Should we worry?”

Less than a month later we have the answer: Yes, Goldman, you should worry, because the historic short squeeze that took place overnight in VIX, which sent it over 100% higher – the biggest jump in history – was precisely a result of this Goldman observation, namely that ETPs were now aggressively shorting vol.

Here is what happened – as Morgan Stanley explained overnight – following this first ever shift by ETPs to net short vega, a move that in retrospect will prove to be suicidal for the entire industry, which now faces one giant termination event.

In short, “the VIX market saw the biggest net buying pressure on record.” According to Morgan Stanley calculations, ETPs had to buy 282,000 VIX futures to rebalance their short gamma: “this was the largest VIX buy in history, dwarfing Friday’s previous record of 78,000.” Dealers hedging their short gamma exposures likely contributed to VIX futures demand as well.

And since most of the rally in VIX futures happened after the 4:00 pm cash close, there was no time for investors or the issuers of the VIX ETPs to react.

It gets better: according to Morgan Stanley this move was “incredible” particularly because VIX and VIX futures were already elevated – and the amount of volatility to buy exceeded the bank’s already aggressive estimates (below shows what QDS estimated coming into Monday) and speaks to the size of the short vol exposures in the market:

While this explains the theory, the question is what happens in practice next: will the inverse ETPs – like XIV – continue to exist today? This is up for debate at time of this writing, but for the broader market the implication is clear: the inverse ETPs have effectively delevered down to zero, going from short 230,000 VIX futures to short just 4,000.

The good news from the effective wipeout of a major part of the vol-selling market is that “this means there is much less risk going forward of further vol to buy from rebalancing of these products.”

The bad news: holders of the inverse ETPs lost $3.4bn as the products went nearly bankrupt and this removes a steady source of volatility supply over the last year.

US stock futures point to a third day of big losses, global markets plunge

- Dow futures were indicating a roughly 540 point drop at the open.

- On Monday, the Dow Jones industrial average dropped 1,175.21 points to close down at 24,345.75 —having briefly declined more than 1,500 points during the session.

- Oil prices and bitcoin futures came under sharp pressure as the global sell-off continued to drag on sentiment

The Fed’s Dependence On Stability

Those curious can read more on what a XIV termination event is here.

“Biggest Theft In Crypto History:” Over $400M Stolen From Japanese Crypto Exchange

Coincheck itself told financial authorities that it had lost 500 million NEM cryptocurrency coins in today’s cyberheist, which at the current exchange rate amounts to roughly $400 million, according to Nikkei. NEM Foundation president Lon Wong also confirmed Coincheck was hacked, calling the stolen funds “the biggest theft in the history of the world”

Donald Trump Reminds Davos Elites of ‘Duty of Loyalty to the People’

Goldman: “Risk Appetite Is Now At Its Highest Level On Record”

State Deals Blow to Federal Reserve, House Passes Bill To Treat Silver and Gold as Money- Plz ReTweet #wakingtimes

Trump will deliver a ‘very carrot-and-stick’ address to billionaires and world leaders at Davos

- President Donald Trump is set to address a crowd of billionaires, world leaders, and reporters at the World Economic Forum in Davos, Switzerland, and an unnamed official told Axios he was likely to deliver an address unlike anything heard there before.

- Last year at the conference, Chinese President Xi Jinping gave a sweeping defense of globalization. Trump is expected to do the opposite.

Logo of Saudi Aramco is seen at the 20th Middle East Oil & Gas Show and Conference (MOES 2017) in Manama, Bahrain, March 7, 2017. REUTERS/Hamad I Mohammed/File Photo

Logo of Saudi Aramco is seen at the 20th Middle East Oil & Gas Show and Conference (MOES 2017) in Manama, Bahrain, March 7, 2017. REUTERS/Hamad I Mohammed/File PhotoSaudi Oil Company’s IPO Has Turned Into A Geopolitical Fist Fight

Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts

Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts

– Gold and silver COT suggests bottoming and price rally coming

– Speculators cut way back on long positions and added to short bets

– Commercials/banks significantly reduced short positions

– Commercial net short position saw biggest one-week decline in COMEX history

– ‘Big 4’ commercial traders decreased their short positions by 28,800 contracts

– Seasonally, January is generally a good month to own gold (see table)

– “If history is still reliable, January will be a great month to own precious metals”

Have you found the gold price in the last few months to be particularly boring? Well, fear not as it looks like it might all be about to take a turn upwards. Last Friday’s Commitment of Traders (COT) report signaled we are close to bottoming and suggest that both gold and silver should have a positive January and Q1, 2018.

As John Rubino wrote in his latest note, ‘gold futures traders have finally started behaving “normally.”’ This simply means that speculators are finally beginning to cut back on long bets whilst commercials and large bullion, the “smart money” and the “inside money” have reduced their shorts dramatically.

This was seen in gold and also in silver, the industrial, technological precious metal. Historically when commercial and speculator positions are brought into balance then this has proven to be bullish for the precious metals.

Previously peaks in net commercial short interest have often happened alongside sell-offs, subsequently valleys in commercial short interest have almost always coincided with nearby rises in price. This could be a positive indicator for the next few months in both gold and silver prices.

“The Leaders Are Crashing” – It’s Not Just Junk Bonds That Have Given Up

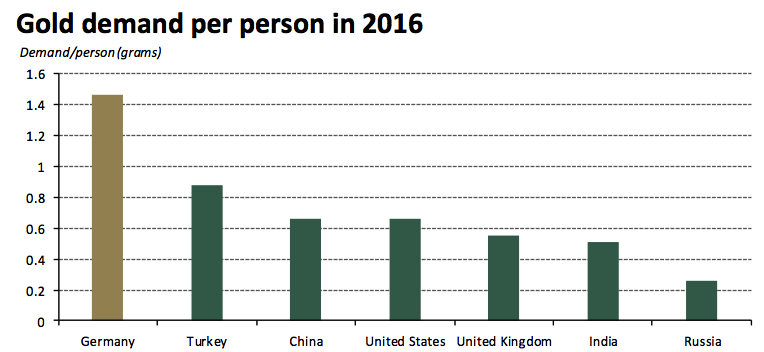

German Investors Now World’s Largest Gold Buyers

– German gold demand surges from 17 ton-a-year to a 100 ton-plus per year

– €6.8 Bln spent on German gold investment products in 2016, more per person than India and China

– Germans turned to gold during financial crises and ongoing euro debasement

– Evidence of latent retail demand on increased economic concerns

– “Gold fulfils an important long-term, wealth preservation role in German investors’ portfolios”

Editor: Mark O’Byrne

India and China often grab the headlines as the world’s largest buyers of gold. In 2016 this was not the case.

When measured on a per capita basis it is Germany that takes the impressive crown of largest gold buyer in 2016, all thanks to their investment market. Last year the country set a new personal best, ploughing as much as £6.8bn ($8 bn) into gold coins, bars and exchange-traded commodities (ETCs).

This is impressive considering that back in 2008 the amount of gold purchased by Germans barely registered outside of the country. A new World Gold Council report records that ‘average demand between 1995 and 2007 was a modest 17 tonnes’. In some of those years they weren’t even net-buyers.

In 2008 this began to change as ‘the global financial crisis brought gold to the attention of German investors at large.’ By 2009, the German gold investment market became one of the world’s largest, with annual coin and bar demand growing four-fold from 36t in 2007 to 134t in 2009.

Since then it has continued to climb, as explained in the latest World Gold Council report:

Germany has established itself as a 100t-plus per year market for bars and coins, and a vibrant domestic ETC market has developed: during Q3 2017, German-listed ETC AUM hit an all-time high of 252.1t, equivalent to €9.8bn.

So what changed and can the country keep up this record-breaking?

What changed?

Kyle Bass Interviews Mark Cuban: “AI Will Help The FANG Stocks Crush Bitcoin”

The Economic End Game Continues

Bitcoin Just Spiked Back Above $6000 As Catalan Considers Blockchain-Backed e-Residency Program

Blockchain And Gold Like Peanut Butter And Chocolate?

Someone Just Panic-Bid For Over $2 Billion Notional In Gold Futures…

Bill Gross: “We Have Fake Markets Because Of The Fed”

Repeating an argument he has made increasingly more forcefully over the past few years, former bond king, Bill Gross, now at Janus Henderson where he oversees the $2.1 billion Unconstrained Bond Fund, said late on Monday that financial markets are artificially compressed, in the process distorting capitalism because of the U.S. Federal Reserve’s loose monetary policy.

“I think we have fake markets,” Gross said at a Janus Henderson event quoted by Reuters.

He added that investors should brace for higher bond yields as the Fed begins to unwind its quantitative easing program but yields will edge up “only gradually.”

Repeating observations made here, and elsewhere countless times, Gross said the Fed’s loose monetary policy had resulted in investors chasing yield and thus producing tight corporate spreads everywhere around the globe (but especially in Europe where junk bonds now yield less than matched maturity US treasurys due to the monetization distortions of the ECB).

“Even China and South Korea – perfect examples of the risk trade – are at very narrow (corporate spread) levels. There is no real advantage in the global marketplace. Everything is so tight, it is hard to pick a winner from a group that is fake.”

Gross also reiterated his previous warning that Fed Chair Janet Yellen and other global policy makers should not rely on historical models such as the Taylor Rule and the Phillips curve “in an era of extraordinary monetary policy.”

Of course, if Gross doe put his money where his mouth is – so to speak – and acts in a fiduciary duty in line with his convictions, he should return capital to investors immediately and wait until such time as market are no longer “fake” and where investors such as Gross have an edge. Somehow we doubt this will happen, however, prompting the question whether one needs fake traders to navigate these fake markets…

Putin orders to end trade in US dollars at Russian seaports

To protect the interests of stevedoring companies with foreign currency obligations, the government was instructed to set a transition period before switching to ruble settlements.

According to the head of Russian antitrust watchdog FAS Igor Artemyev, many services in Russian seaports are still priced in US dollars, even though such ports are state-owned.

The proposal to switch port tariffs to rubles was first proposed by the president a year and a half ago. The idea was not embraced by large transport companies, which would like to keep revenues in dollars and other foreign currencies because of fluctuations in the ruble.

Artemyev said the decision will force foreigners to buy Russian currency, which is good for the ruble

Zimbabwe: Gold Reserves to Back Currency

By George Maponga

Government is building diamond and gold reserves to back the local currency upon its re-introduction in future, Vice-President Emmerson Mnangagwa has said. VP Mnangagwa refused to disclose when the local currency would be re-introduced, but said it would only come back when mineral reserves reached desired levels.

He was speaking during an advocacy meeting on the new Constitution that was organised by the Ministry of Justice, Legal and Parliamentary Affairs in Chiredzi.

VP Mnangagwa oversees the Justice Ministry.

Responding to questions on the prevailing cash shortages, the Vice President said Government was working on ways to stem the shortages.

Does Anyone Actually Care That The Exploding National Debt Is Destroying Our Future?

S&P Plunges To Critical Technical Support As VIX Spikes

Russia Backpedals On Bitcoin – Unveils Plan To Ban Cryptocurrency Sales To “Ordinary People”

After local Russian media reported earlier this year that the Russian Parliament could legalize bitcoin as soon as 2018, Deputy Finance Minister Alexei Moiseev this week signaled that authorities might instead seek to restrict its use. During an interview with Russia 24, a state-owned news channel, Moiseev said that Russian authorities should treat cryptocurrencies, including bitcoin, as sophisticated financial assets and restrict their use and trading to qualified investors only.

Moiseev’s statement surprised members of Russia’s digital currency community, who had been lead to believe that the Russian government was finally warming to digital currencies after years of skepticism. That belief was strengthened earlier this month when an aide to Vladimir Putin announced that he would seek to raise $100 million to build bitcoin mining infrastructure in Russia, with the goal of controlling as much as 30% of the bitcoin network’s hashpower.

“’Cryptocurrency should be regulated as a financial asset,’ Vedomosti reported him saying. ‘There is a point of view that cryptocurrencies such as bitcoin is a financial pyramid. Investments [in] such are high-risk. This determines our approach to their regulation.’

RBC quoted him saying: “We propose to call it a currency, but regulate it as other property, qualify it as a financial asset and allow only qualified investors to buy and sell them on the exchange.”

As a regulated financial security, Moiseev said cryptocurrencies would be sold through stock exchanges under the supervision of the Federal Financial Monitoring Service of the Russian Federation, also known as Rosfinmonitoring, according to Bitcoin Magazine.

Moiseev added that bitcoin is a “dangerous” investment, and that it’s the government’s duty to protect “ordinary people” from losing their shirts, according to CoinTelegraph.

“For ordinary people, there’s no way because these are very dangerous investments that could lead to loss of money.”

According to Moiseev, Russia’s ministry of finance is discussing how to proceed with the central bank and the Moscow stock exchange. Moiseev added that it is necessary for cryptocurrencies to sell through the exchange “to provide judicial protection to participants in transactions.”

Moiseev detailed that this approach to cryptocurrency regulation aims to protect the rights of buyers and sellers. “Now people do it at their own peril and risk, they have no judicial protection. This is our first task,” he was quoted by Vedomosti.

His comments then turned to the subject of money laundering.

“Citing Western Europe and Russia in particular, Ria Novosti quoted him saying “the use of cryptocurrency for illegal operations has become much more frequent because the mechanisms for combating money-laundering are not yet fully applied in all countries to cryptocurrencies.”

Finally, Moiseev said that the Russian government is uncomfortable with the anonymity provided by bitcoin.

“Moiseev also explained that it is necessary to sell bitcoins through the regulated stock exchange, so that the regulator will always know ‘who the seller is, who the buyer is, where these bitcoin accounts have moved.’”

What’s worse for bitcoiners is that Russia might be at the vanguard of a shift in how authorities view bitcoin. The SEC late last month declared that digital currencies, including bitcoin and the tokens issued during ICOs, should be treated as securities under the law.

So far, the SEC’s guidance has been vague. But the ease with which digital currencies could be used to finance illicit activities – regardless of whether they’re actually being used for that purpose – likely means that more government crackdowns are ahead. By requiring all local bitcoin exchanges to screen transactions for potential violations, China has found a way to pierce the anonymity surrounding digital-currency transactions.

Don’t think it can’t happen in the US.

Bitcoin, Sour Grapes, And The Institutional Herd

Ethereum, Bitcoin Crash After China Declares Initial Coin Offerings Illegal

De-Dollarization Accelerates: China Readies Yuan-Priced Crude

Oil Benchmark Backed By Gold

$20 Oil? Forget OPEC, China Controls Oil Prices

Bitcoin’s Biggest Problem, Revealed

Wednesday was the second day of the Woodstock Music Festival. At this time, 48 years ago, I was not — along with many others — exactly of sound mind! This Wednesday morning’s rambling, nearly five decades later, may…

Watch : Janet Yellen Testifies Why The Fed Is Once

“The Singaporean banks have regional ambitions, and for them, increasing the size of their private bank is a good way to grow,” said Jan Bellens, EY Asia-Pacific banking and capital markets leader and global emerging markets leader.

“For the Swiss players, I think it is a case that Asia is where the growth is at a time when things are more challenging in their home market.”

Activity in the Asian private banking space in recent years has primarily been among mid-sized players which are either looking to gain size to compete, or withdraw from the market.

The top six places in the table were unchanged from 2015. UBS, with its US$286 billion of AUM, fended off Citi and Credit Suisse to maintain the No 1 spot.

Despite all the comings and goings, assets under management at the top 20 private banks in Asia grew by 6 per cent in 2016 to reach a record high. Collectively, they managed US$1.55 trillion of the region’s wealth in 2016, excluding mainland China, according to the magazine’s calculations.

The magazine noted, however, that AUM growth excluding onshore China was dwarfed by that of Chinese banks. China’s top five private banks have increased their AUM by an average annual growth rate of 27 per cent since 2012, while the top five Asian banks excluding onshore China achieved CAGR of just 6.4 per cent.

The attractions for international private banks of servicing this onshore Chinese wealth are significant, but doing so involves a number of challenges, most recently the strict controls on capital leaving China.

“A number of the international private banks have stated that their aim is to service onshore Chinese wealth, but it is not yet clear what a successful operating model might be,” Bellens said.

China dumping U.S. Treasury debt in record volume… is this a prelude to the globalist assault on Trump’s economy?

China was recently the largest holder of US treasury securities, but has now lost that title to Japan after China started selling their securities rapidly. Chinese authorities are sacrificing their coveted position with significant financial and diplomatic value. They are preparing to engage in a bigger battle, to protect the Yuan’s value from plummeting. The battle is set to intensify this year, when President Donald Trump challenges the Yuan, along with China’s devaluation practices.

China’s holdings in US Treasury bonds recently fell by $66 billion. The US Treasury department said it was their 6th consecutive month of selloffs. But that’s only a fraction of their holdings, China now has their lowest amount of Treasury holdings since early 2010. Analysts predicted that trend would continue in November and December, and it did. The selloffs were a prudent move in which China needed in order to raise funds to protect the Yuan’s value, which is currently being pushed down by capital flight and the rising dollar.

JP MORGAN GOBBLES UP A MINIMUM OF OVER 31 TONS (POSSIBLY UP TO 186 TONS!) OF PHYSICAL GOLD!

Back in August 2015, I noted that Goldman Sachs and HSBC had taken delivery of a huge tonnage of physical gold, probably purchased near the lows. Physical bars of gold are, by definition, a very long term investment in the yellow metal. At the time, the two banks were telling clients and others not to buy gold, even as they were loading up on it, themselves.

Let’s fast forward…

Starting in December 2015, JP Morgan began buying tremendous quantities of physical gold, as opposed to paper/electronic gold futures, forwards, ETF certificates etc. From December 1, 2015 to December 29, 2016, the big bank purchased and took physical delivery of over 31 metric tonnes worth of bars of the yellow metal for its house account at COMEX alone.

In other words, it now has a physical gold pile which, at minimum, is worth over $1.1 billion at $1,140 per troy ounce, and it is an asset of the corporate bank. By May, 2016, unlike the actions of GS and HSBC in buying while advising clients to sell, analysts at JP Morgan were beginning to encourage customers to buy gold also.

Let me repeat that the enormous purchase of 31+ tonnes of traceable physical gold occurred at New York’s COMEX exchange. The so-called “OTC” gold market in London is five times larger than the gold market in New York City, and if they were buying at COMEX, they were probably buying in London also. The problem with London is that the “LBMA” is not a formal exchange with disclosure rules and regulatory oversight. It is simply an informal collection of banks who operate by agreeing to a common set of rules of engagement. Transactions are secret….

Might the globalists who’ve been working with impunity to bring down America to install their totalitarian, dictatorial ‘new world order’ use a collapse of the economy, their ever-present ‘shadow government’, an assassination attempt upon the life of Donald Trump or a Soros/Clinton funded ‘purple revolution’ to complete their long-held goals now that they realize that time may berunning out on them with Trump only 2 months away from taking office?

While we pray that the above mentioned possibilities never play out and Trump at least gets into office to show America what we’ll look like under his leadership, we should remember that Trump warned that the world faces possible economic collapse, and we should always be prepared for anything and everything that might come our way.

The establishment is clueless. Hopelessly corrupt. Immeasurably incompetent. The media, the political elite, the criminal bankers, the idiotic academics… they have absolutely no clue about the size of the fervent backlash that’s headed their way.

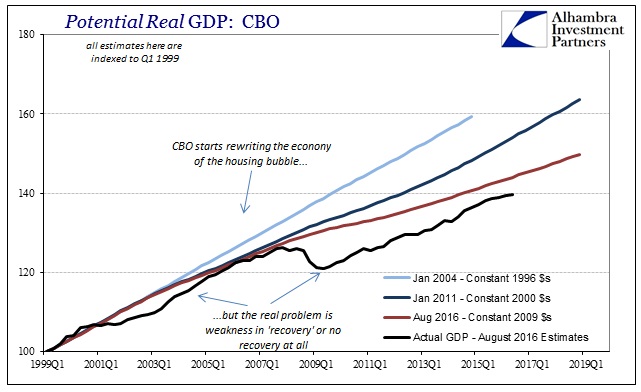

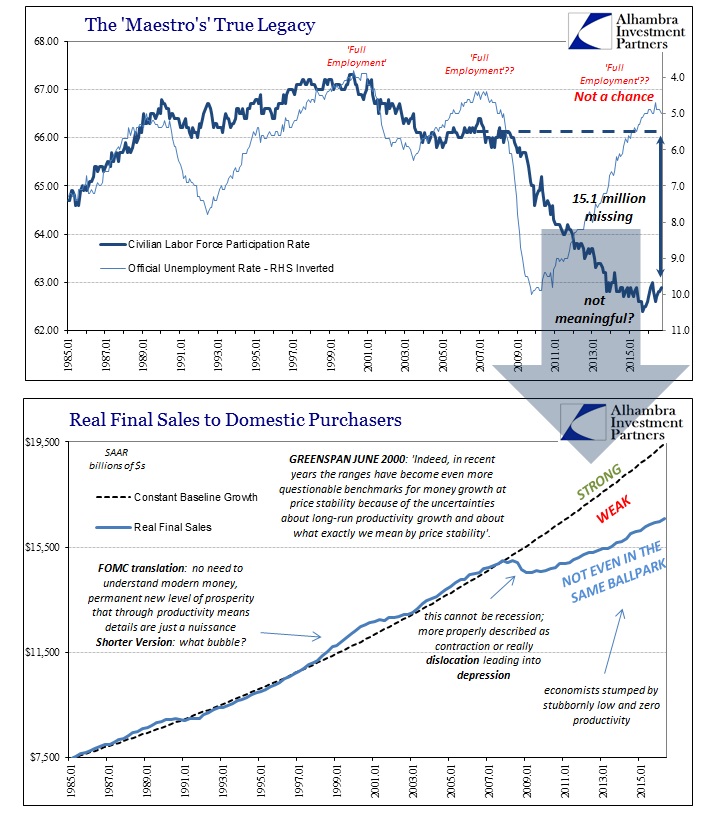

“The Fed Failed ….” And that Changes Everything

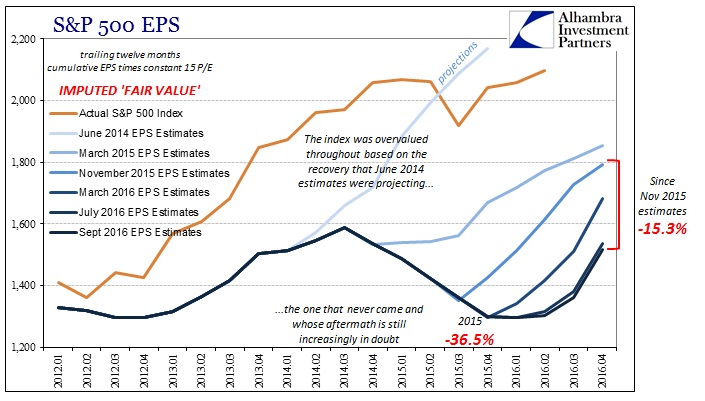

By Jeffrey Snider, Alhambra Investment Partners

There is a growing body of public work that suggests Federal Reserve officials are prepared now for avery different sort of normalization than what had been envisioned up until this year. That comes, as noted earlier, with the realization that the economy is not just in rough shape but likely to remain that way for the foreseeable future.

The important caveat left off that bleak pronouncement is actually ceteris paribus. So long as the current policy and monetary system remains firmly in place, there is little hope the global economy will just spontaneously ignite. Since economists and central bankers have made it clear they aren’t going anywhere despite being wrong about everything up to now, here we are.

Even Janet Yellen has been forced to concede that even if the Fed does manage to get on with further rate hikes, the ultimate destination for them in nominal terms is much less than prior “cycles.” Current thinking seems to be aiming for around 3% for the federal funds rate rather than 5% as had long been accepted. The way things are going, and as the Japanese showed, they will be lucky to get even half that far.

But in what can be only another sign of just how twisted, upside down, and easily receptive to pretzel logic the mainstream is now, that is supposed to be a good thing especially for stocks. Writing today for BloombergView, Mohamed El-Erian, chief economic advisor for Allianz, makes this exact argument.

Equity investors have also been reassured by the growing — and correct — recognition that this Fed hiking cycle will depart drastically from historical norms. Instead of following a relatively linear path of increases at regular intervals, it will have pronounced “stop-go” characteristics. Also, and perhaps more importantly, the endpoint — or what economists call the “neutral rate” — will be considerably lower than recent historical averages.

How in the world is that a good thing that would “reassure” equity investors? Truly rational investors make decisions based on discounted information about the future, and what El-Erian suggests here (and he hasn’t been alone) is that stock investors show more preference for “accommodative” monetary policy than actual growth. A lower rate ceiling implies without much ambiguity continued awful economic conditions here and elsewhere around the world. But to the screwed up nature of mainstream thought, so long as monetary policy is lower overall continued stagnation is forgiven, perhaps even to be mildly celebrated?

What does it mean by claiming “accommodation” that gives “investors” so much apparent comfort? It can’t mean that in economic terms for obvious reasons; instead we are led to believe that low (meaning desperately insufficient) growth isn’t all that bad so long as interest rates don’t rise too far. Investors are supposed to be paying for growth, not the failure of interest rate “stimulus” to seed it. If the Fed feels it can’t raise rates all that much, with a true “ceiling” yet to be determined, it is a much riskier, not less risky, environment.

The idea of a lower R* or r-star is truly a defining defeat, though it is, like El-Erian’s attempt here, being spun into what is nothing more than rationalization. As I wrote in September, the falling R-star can mean nothing else:

There is more complexity when we talk about inflation, of course, but by and large it is commodity prices that have thwarted John William’s (or Janet Yellen’s) “normalizing” narrative. Commodities have been falling more intensely since the middle of 2014 but really dating back to the middle of 2011. Both of those inflections recall and are related to obvious eurodollar or global wholesale money events. Thus, even subscribing to Wicksell’s theory, the current rate must now be, as it has been, above the natural rate, unambiguously indicating “tight” money. Whether it is via Friedman’s interest rate fallacy or Wicksell’s natural rate hypothesis, both arrive at the same conclusion due to seemingly intractable market prices.

Central banks assume that means they have to “stimulate” more when in fact it is just their math telling them they haven’t stimulated at all – at least not where it counts and has been needed. Translating depression into econometrics is a long and costly affair, but it is at least starting to be done, slowly and in discrete pieces. R* may yet be of some great value, insofar as further calculating just how little monetary authorities know about money.

Reception of and belief about QE have been very much cult-like and it was thus too thinly constructed to withstand being so thoroughly debunked. This is not even close to making the best of a bad situation; it is instead claiming positive attributes that just don’t exist, being downright offensive to common sense. How anyone, let alone El-Erian, wrote that paragraph (contained within an article further rationalizing the latest of the “rising dollar”) without awareness of its very basic flaw can at best be described as intentionally obtuse while still bordering upon nakedly deceiving. The world of the near future is going to be bad, worse than everything “we” have been expecting, but take heart, the Fed’s monetary policy will reflect just that. Translating it from the original mainstream thought-bubble language truly reveals its truly absurd premise… The Fed failed, and that changes everything; including and especially what is to be made of “accommodation” and what it is that might have “reassured” equity investors in the past and might do so (or not) going forward.

The Latest Deutsche Bank Scandal Reeks Of Enron: 103 “Enhanced Repo” Deals To Make Loans “Disappear”

The Run Begins: Deutsche Bank Hedge Fund Clients Withdraw Excess Cash

Deutsche Denial Tsunami Begins: Draghi “Not ECB Fault”, IMF “Solid Base”

The Mainstream Media Bet The Farm On Hillary… And Lost

“Global Market Rout” – Bond Selloff Snowballs Into Stock Liquidations On “Stimulus Pullback” Fears

Exclusive: ‘Flash Boys’ protagonists aiming new exchange at gold

IEX Group, which rose to prominence with its bid to shake up stock trading in the United States, now aims to do the same in the more than $5 trillion-a-year gold market with a new exchange being created by its spinoff TradeWind Markets, a board member of the new venture said on Tuesday.

The protagonists of Michael Lewis’s book, “Flash Boys: A Wall Street Revolt,” are planning a gold exchange that would use elements of blockchain technology to improve transparency and the clearing and settling of trades, said Matt Harris, a managing director at Bain Capital Ventures. Bain has an investment in IEX.

Blockchain is a tamper-proof shared ledger that can automatically process and settle transactions using computer algorithms.

TradeWind Markets began as an internal project of IEX and was spun off as a separate firm earlier this year. In June, the startup raised $9 million, according to a regulatory filing with the U.S. Securities and Exchange Commission. A person familiar with the operation who asked not to be identified because the plans are not public, said the funding came from IEX and Sprott Inc (SII.TO), a Canada-based investment firm that manages physical bullion funds……

Wall Street’s Latest Retail Fleecing Product Exposed – Structured CDs

![Live 24 hours gold chart [Kitco Inc.]](http://www.kitco.com/images/live/gold.gif)