Five88 - siêu nhà cái đa dạng tỷ lệ cược uy tín

Giới thiệu về FIVE88

Five88 là gì?

Bên cạnh đó những dịch vụ và chức năng của nhà cái này cũng rất nổi bật với sự tiện lợi được đặt lên hàng đầu từ giao dịch, rút nạp, cho đến việc hỗ trợ giải quyết các vấn đề cho người dùng trong quá trình tham gia các trò chơi được tổ chức tại Five88.

Với những lý do trên nhà cái thể thao Five 88 nhanh chóng đạt được đẳng cấp hàng đầu Châu Á và ngày càng thu hút được số lượng người chơi tăng dần qua từng năm.

Tin đồn Five88 lừa đảo? (cập nhật 11/2024)

Là một nhà cái lớn mạnh vào những năm gần đây, Five88 không tránh khỏi các sự cạnh tranh không lành mạnh từ các đối thủ trên thị trường. Các đối thủ cạnh tranh nhằm mục đích hạ uy tín Five88 trực tiếp để kéo các khách hàng vốn có về phía họ. Nhưng các động thái đó chỉ làm tăng Five88 có thêm sự vững chắc về độ uy tín cao khi khách hàng trực tiếp gọi điện lên hotline Five88 để hỏi những dịch vụ và khuyến mãi mà nhà cái Five88 bóng đá không hề cung cấp.

Cho nên việc Five88 lừa đảo chỉ là tin đồn không có thật mà các đối thủ cạnh tranh dựng nên. Khi các bạn vào trang web lạ nhưng lại xưng là đại lý Five88 thì nên gọi thẳng hotline để hỏi rõ và chỉ có nhà cái Five88 chính thức mới hỗ trợ được cho các bạn. Vậy người chơi thông minh là người chơi hiểu rõ nhà cái mình nhất các bạn nhé!

Cập nhật 3/2023 về tin đồn Five88 lừa đảo: đã xác thực được tin đồn Five88 lừa đảo là vô căn cứ. Sự việc do một nhà cái đối thủ tạo nên dư luận nhằm hạ uy tín của nhà cái Five88, hiện tại nhà cái đối thủ đã “bốc hơi” trong khi Five88 vẫn trụ vững tiếp bước phục vụ khách hàng trong năm 2023 này!

[/accordion-item]Giai đoạn phát triển tốc độ vượt bậc của trang cá cược Five88

Những bước đầu thần tốc của ngôi sao nhà cái Five88 me

Five88 – Là nhà cái thể thao mẫu mực trong làng cá cược trực tuyến hiện đại trong những năm gần đây có tốc độ tăng trưởng đến “chóng mặt”. Nhà cái Five88 bong da được cộng đồng cá cược online đánh giá là nhà cái uy tín về: nạp rút tiền nhanh chóng, hỗ trợ người chơi nhiệt tình 24/7, đa dạng tỷ lệ kèo cược bóng đá và là nhà cái có nhiều game cá cược nhất thời điểm hiện tại.

Giai đoạn ổn định khẳng định mình của Five88 live

Mặc dù đôi khi bị nhà mạng chặn tại Việt Nam, nhưng Five 88 luôn liên tục khẳng định độ uy tín của mình bằng cách nâng cấp đường truyền của mình để khách hàng có link vào Five88 trực tiếp nhất có thể.

Cùng với những đầu tư khổng lồ của mình vào trang cược giải trí Five88 đăng nhập, nhà cái Five88 đã trở thành địa chỉ đáng tin cậy nhất trên cộng đồng mạng về cá cược giải trí trực tuyến với kho game đa dạng và tỷ lệ cược nhiều nhất hiện nay.

Thông tin Five88 bị sập? Nhà cái Five88 com lừa đảo?

Hiện nay các tin đồn Five88 bị sập trên cộng đồng mạng gây hoang mang cho người dùng, thực tế điều này không đúng vì đây là hành động chuyển domain vì mục đích nâng cao dịch vụ và nâng tầm thương hiệu nhà cái Five88.

Cụ thể lịch sử các thay đổi đường link vào Five88 gần đây:

- 6/2022:

Five88.comchuyển sangFive88.me, giai đoạn này khách hàng vẫn vào domain .com cũ do đã quá quen thuộc nhưng do nhà mạng Việt Nam chặn IP người Việt quá nhiều nên nhà cái đã quyết định thay đường dẫn khác để người dùng dễ vào hơn. - 10/2022: từ

Five88.mechuyển sang Five88.win cũng vì lí do nhà mạng “rong ruổi đuổi theo” để chặn Five88 tiếp cận người chơi. Nhưng “anh đuổi thì em chạy” là hình ảnh “vui vẻ” của các nhà cái hiện này và đây là đường link trang chủ của nhà cái Five88 duy nhất chính chủ mà các bạn muốn vào: https://five88.win/ giữa các trang giả mạo nhà cung cấp Five88 lừa đảo nhan nhản trên google search.

Và đặc biệt để bù đắp sự gián đoạn nhỏ này, nhà cái Five88 đã tung ra khuyến mãi “kết nối bền lâu cùng Five88” tại trang chủ, mong rằng hành động đẹp này sẽ mang lại độ uy tín tăng cao cho nhà cái này.

7 điểm nổi bật khiến Five88 là nhà cái top đầu châu Á (lý do nên chơi tại Five88)

#1 Giao diện đẹp mắt thân thiện người dùng

Giao diện được thiết kế đẹp mắt và đặc biệt là các nút điều hướng vô cùng thân thiện với người dùng, giúp người dùng dễ dàng di chuyển đến các game, mục mình cần đến trong vài click chuột.

Với sự sắp xếp khoa học trên trang chủ, nhà cái Five88 trực tiếp đã chủ động mang đến cho khách hàng một cái nhìn mới mẻ và dễ sử dụng tất cả mọi sản phẩm chu đáo và tận tâm. Khách hàng đã cho điểm cộng lớn này vào top các điểm cộng tại Five88.

#2 Đường truyền ổn định với máy chủ tại nước ngoài

Ưu điểm mấu chốt của cả một nhà cái là đường truyền ổn định và liên tục. Five88 đăng nhập có hệ thống máy chủ tại nước ngoài với tốc độ đường truyền cao và cực kỳ ổn định giúp các trận đấu được đảm bảo livestream liên tục truyền tải đến khách hàng đang chơi và xem trực tiếp.

Vậy Five88 bị chặn không? Câu trả lời là không. Máy chủ nước ngoài giúp nhà cái Five88 kết nối duy trì ổn định cho khách hàng vào website trang chủ để tham gia cá cược trực tuyến. Đảm bảo các cuộc chơi game, giao dịch thanh toán trên Five được duy trì và không giật lag. Nếu chơi game lag thì chơi làm gì, phải không nào?

#3 Cá cược đa dạng tỷ lệ cược nhất tại châu Á

Suy cho cùng thì Five88 có hợp pháp không? Đây là câu hỏi luôn xuất hiện đầu tiên trong đầu anh em cược thủ. Cho đến nay, nhà cái Five 88 là nhà cái hàng đầu với đa dạng tỷ lệ cược nhất châu Á. Với các tỷ lệ cược: Decimal, Malaysia, Indonesia, Hongkong, Macau,… khiến khách hàng cực kỳ yêu thích sự đa dạng và mới mẻ này khi chơi.

Các tỷ lệ cược tại Five88 luôn được cập nhật kịp thời tại thời điểm cược giúp khách hàng luôn nắm bắt chính xác thông tin cược để có quyết định chơi trận đó hay không.

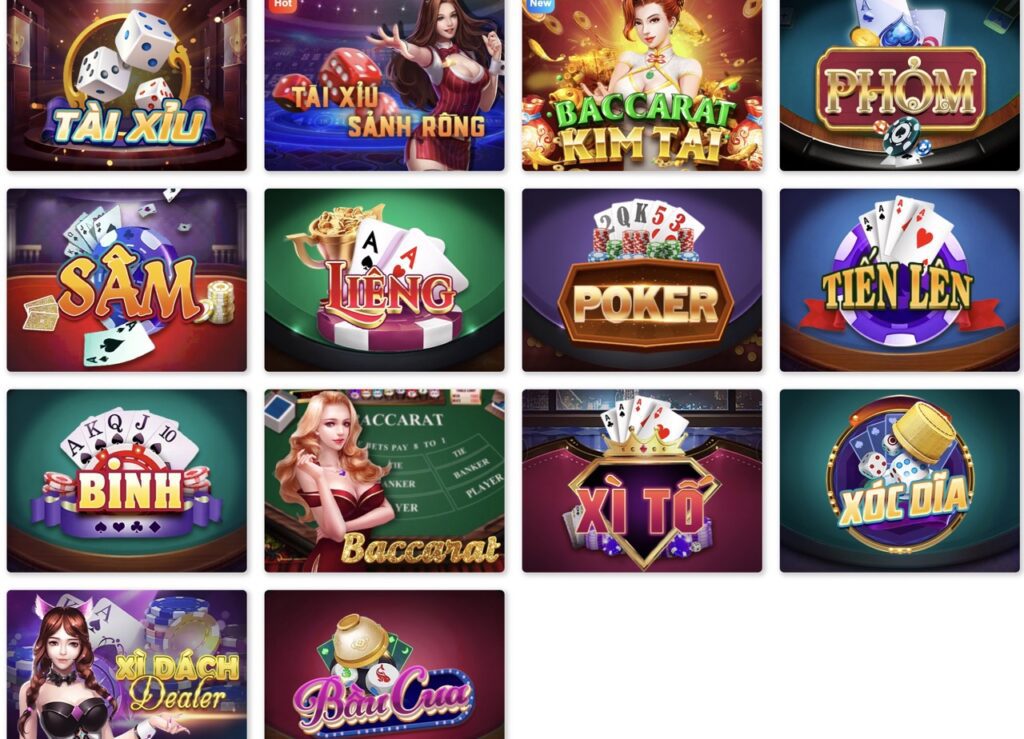

#4 Kho game đổi thưởng nhiều và đa dạng

Điểm cộng lớn cho nhà cái Five88 là kho game tại đây vô cùng phong phú với nhiều game và cách chơi không thể đa dạng hơn. Game đổi thưởng Five88 có tỷ lệ trả thưởng vô cùng cao mà tỷ lệ để trúng thưởng lại rất cao. Phù hợp cho những ai muốn kiếm tiền hàng ngày.

Thiết kế trong game Five88 rất bắt mắt, lại vui nhộn làm cho khách hàng càng ngày càng thích chơi game đổi thưởng tại Five88 hơn sau những trận cược trực tuyến căng thẳng. Phải kể đến các game: bắn cá, Keno, xóc đĩa, tài xỉu, table games (cờ úp), đua ngựa 3D,…

#5 Nạp rút tiền nhanh và tiện lợi

Mọi sự uy tín của một nhà cái là tốc độ nạp rút tiền nhanh và đúng chính xác. Thêm một điểm cộng cho nhà cái Five88 là giao dịch thanh toán tại đây vô cùng nhanh mà lại còn tiện lợi cho những ai không quen sử dụng giao dịch thanh toán trực tuyến.

Nạp tiền tại Five 88 với tốc độ như chớp trong vòng 2 phút. Với đa dạng cách thức nạp tiền: ngân hàng, thẻ cào, ví momo và tiền ảo (chưa nhà cái nào có cái này)

Rút tiền tại Five88 thì quá là nhanh và uy tín. Các bạn thực hiện rút tiền trên Five88 trực tiếp sẽ nhận được đúng và đủ tiền rút với tỷ lệ không đổi là 1:1, nghĩa là bạn rút 100,000 đ sẽ nhận đúng 100,000 đ vì nhà cái không thu tiền phí gì cả.

#6 Bảo mật thông tin tuyệt đối

Điểm uy tín số 1 khi đăng nhập Five88 là luôn bảo mật thông tin khách hàng tuyệt đối. Five88 cam kết không bán hay chia sẻ thông tin của người dùng khi tham gia chơi cược tại đây. Nha cai Five88 live luôn đảm bảo sự minh bạch trong kinh doanh và bảo vệ người dùng tuyệt đối khi đã tin tưởng và chơi tại nhà cái.

#7 Hệ thống chăm sóc khách hàng nhiệt tình và tận tậm

Điểm cộng lớn nhất cho m Five88 là hệ thống chăm sóc khách hàng (CSKH) nhiệt huyết của mình dành cho người chơi. Hệ thống CSKH Five88 luôn thể hiện sự chuyên nghiệp của mình khi hỗ trợ giải quyết các vấn đề khách hàng gặp phải khi tham gia cược và chơi game trên đây.

Tổng đài CSKH khi đăng nhập Five88 luôn làm việc hết công suất 24/7 để phục vụ 365 ngày không nghỉ lễ tết cho người chơi, nhằm đảm bảo trải nghiệm cá cược trực tuyến tại Five88 bóng đá của khách hàng luôn kết nối và duy trì ổn định.

Siêu khuyến mãi hấp dẫn cược thủ hàng ngày tại Five88

Khuyến mãi nạp đầu tặng 100% giá trị nạp cho tân thủ

Với một nhà cái chất lượng như cổng cá cược online này thì việc tung ra những khuyến mãi nhà cái FIVE88 hấp dẫn có chất lượng cao luôn luôn được đặt lên hàng đầu để có thể hướng đến những trải nghiệm tốt nhất cho người dùng của mình.

Ngoài những phần thưởng giá trị, các chương trình khuyến mãi cũng mang đến rất nhiều ưu đãi hấp dẫn và giúp ích cho quá trình tham gia các trò chơi trên trang nha cai five 88 me.

- Tặng 100% cho lần nạp đầu tiên: với lần đăng ký Five88 đầu tiên thì khi nạp bất kỳ số tiền nào vào tài khoản lần đầu sẽ được tặng ngay 100%. Ví dụ: bạn nạp 100,000 đồng vào sẽ nhận lại 200,000 đồng đấy nhé!

Siêu hoàn trả cược 1.58% vô hạn cho anh em cược thủ

Ngoài Siêu khuyến mãi 100% ngay lần Nạp đầu tiên, link vào FIVE88 còn mang đến chương trình Tặng thưởng siêu hoàn trả 1.58% cho khách hàng.

Tiền hoàn trả sẽ tính dựa trên Doanh thu khác nhau của các sản phẩm trên trang. Cụ thể như sau

Các sản phẩm game cược tính 100% Doanh thu cược : Big Hilow, ATOM, Thể Thao, Thể Thao ảo, Keno, Number Game, Quay Số, Spribe ( trò chơi), Trading.

- Áp dụng hoàn trả 1.58% trên 100% Doanh thu cược.

Các sản phẩm tính 60% Doanh thu cược : Lô Đề

- Áp dụng hoàn trả 1.58% trên 60% Doanh thu cược.

Các sản phẩm tính 25% Doanh thu cược: Nổ Hũ, Bắn Cá, Tài Xỉu (Trò Chơi), Baccarat (Trò Chơi), Mini Baccarat (Quay Số), Ngầu Hầm (trò chơi), Rồng Hổ (trò chơi), Roulette (trò chơi).

- Áp dụng hoàn trả 1.58% trên 25% Doanh thu cược.

Ví dụ:- Quý khách cược 10.000.000đ các sản phẩm tính 100% Doanh thu thì số tiền hoàn trả sẽ được tính như sau:

10.000.000đ x 1.58% = 158.000 đồng.

Quý khách cược 10.000.000đ các sản phẩm tính 60% Doanh thu thì số tiền hoàn trả sẽ được tính như sau:

6.000.000đ x 1.58% = 94.800 đồng.

- Tiền cược vào Game bài, Sòng Bài, Lô đề siêu tốc, Mini game, Xèng hoa quả, Space X, Vgaming sẽ không được tính.

- Chương trình được áp dụng bất tận, Quý khách đặt cược sẽ có cơ hội nhận tiền hoàn trả, không giới hạn về số tiền cược và thời gian nhận thưởng.

- Tiền thưởng sẽ được cập nhật vào tài khoản của Quý khách vào lúc 11h45 hàng ngày.

Những sự kiện giá trị trực tiếp từ Five88

Tại các trận bóng được phát từ Five88 trực tiếp, anh em sẽ thường xuyên được đến với những sự kiện hấp dẫn do nhà cái tổ chức với quy mô và giá trị của giải thưởng khủng. Các sự kiện được tổ chức định kỳ giúp cho anh em có nhu cầu có động lực để cày cuốc.

Một số sự kiện đáng chú ý tại Five 88:

- Đua top nhận quà

- Vòng quay may mắn

- Cao thủ bóng đá

- Khai xuân như ý

Chi tiết cách thức tham gia, luật lệ cũng như giá trị phần thưởng, anh em có thể tham khảo chi tiết tại phần “sự kiện” ở trang chủ của website nhà cái thể thao FIVE88.

Sản phẩm game cá cược đa dạng mang thương hiệu Five88

Được phần lớn anh em người chơi trong cộng đồng biết đến là nhà cái thể thao, chính vì thế mà các sản phẩm chính của m Five88 xoay quanh hình thức dự đoán kết quả bóng đá, một hình thức giải trí cá cược online được người chơi tham gia đông đảo nhất hiện nay.

Bên cạnh đó không thể không kể đến là những hình thức giải trí hàng đầu của làng casino game từ quay số, lô đề, sòng bài, game bài đổi thưởng, game bắn cá, game quay slot cày hũ. Sau đây mời anh em cùng tham khảo một số sản phẩm nổi bật hàng đầu tại nhà cái Five88 live.

Sân chơi cá cược thể thao với 4 sân nổi bật của Five88

- T – Sports: Say mê những trận cầu đỉnh cao trên khắp thế giới với tỷ lệ cược bóng đá tốt nhất.

- S – Sports: Những trận cầu đỉnh cao trên khắp thế giới với hàng trăm tỷ lệ kèo kèo đẳng cấp Châu u chuyên nghiệp.

- A – Sports: Những trận cầu đỉnh cao trên khắp thế giới với hàng trăm tỷ lệ kèo theo phong cách Châu Á.

- K – Sports: Nền tảng cá cược hàng đầu châu Á mới ra mắt với tỉ lệ cược hấp dẫn, đa dạng các kiểu cược (ra mắt 08/2022)

Ngoài ra, khi đăng nhập Five88 còn nổi tiếng về cá cược bóng đá với các điểm nổi bật như:

- Giao diện thiết kế thân thiện và khoa học: giúp người dùng tiếp cận được mọi sản phẩm cũng như mối liên hệ với bộ phận CSKH tại nha cai Five 88

- Đa dạng tỷ lệ kèo: một điểm cộng nữa là là khách hàng chơi được nhiều tỷ lệ kèo cược đa dạng từ châu Á đến châu Âu

- Thông tin cá nhân được bảo mật: web nhà cái Five88 bảo đảm tuyệt đối bảo mật thông tin khách hàng chơi cá cược trực tuyến tại đây, nên quý khách hàng luôn yên tâm về bảo mật thông tin.

Xem chi tiết về cá cược thể thao trên Five88 tại đây: https://irnglobal.com/the-thao/

Sòng bài Casino Five88

- Game quay số: Bao gồm 2 hình thức chơi là game quay số 1 và game quay số 2.

- Lô đề: Bao gồm 2 hình thức chơi là lô đề 3 miền và lô đề siêu tốc ( chỉ có tại Five88 trực tiếp )

- Sòng bài trực tuyến: Với hàng chục sòng bài online trên thế giới ở đủ các thể loại game casino hàng đầu hiện nay như Baccarat, Roulette, Xì dách, Poker, Tài xỉu,…

- Trò chơi: Hàng chục đầu game nổ hũ cùng các mini game kahcs với giá trị phần thưởng cũng như jackpot khủng đang chờ anh em đến chơi và sở hữu.

- Game nổ hũ: Chính vì số lượng game nổ hũ tại Five88 live quá nhiều cộng với sự ủng hộ đông đảo của anh em người chơi, thế nên nhà cái đã quyết định tách riêng phần game này ra thêm một trang để anh em đam mê có thể dễ dàng tham gia và nhận được những phần thưởng có giá trị cao.

- Bên cạnh các trò chơi nổi bật trên tại nhà cái Five88 com trực tiếp anh em cũng có thể tham gia number game, keno game và các minigame lôi cuốn khác.

Xem thêm chi tiết về sòng bài Five88 trực tuyến tại đây: https://irnglobal.com/game-bai-five88/

Bắn Cá Nổ Hũ Siêu Vui Nhộn

Game bắn cá tại nhà cái Five88 me luôn được đông đảo game thủ lựa chọn để giải trí xả stress sau những trận cầu căng thẳng theo dõi trực tiếp trên Five88. Bắn cá không chỉ giúp giải trí mà còn đem lại tiền thưởng cao, có khi hơn cả 10 tỷ đồng. Hũ cá luôn được “châm” đầy để kích thích các cao thủ săn cá cày hũ vào cuộc chơi đầy vui nhộn nhưng không kém phần hấp dẫn đấy nhé!

Các game bắn cá đang hot và hiện có trên game Five88 bao gồm:

- One Piece – Đại Hải Trình : cùng các bạn của Vua Hải Tặc tương lai – Monkey D. Luffy săn cá lớn nào!

- Tiên Bắn Cá : “rinh” những nàng tiên cá về trong cuộc du ngoạn ở đại dương mênh mông nhé!

- Tam Tiên Bắn Cá: cùng các ông thần tiên Phuc-Lộc-Thọ giải trí bắn cá tại Five88 nhé!

- Săn Khủng Long: trở về thời tiền sử để chinh phục các bạo chúa khủng long đang ôm hũ nhé!

- Thiện Xạ Bắn Cá: cầm cung và bắn để trở thành tay cung thiện xạ bạn nhé!

- Chúa Tể Đại Dương: cùng Five88 săn hũ mà chúa tể đại dương – Godzilla đang giấu ở đáy sâu đại dương!

Xem thêm cách bắn cá tại Five88: https://irnglobal.com/ban-ca-one-piece-five88/

Game bài trực tuyến tại game Five88

Nhà cái Five 88 thấu hiểu được tâm lý khách hàng có nhu cầu giải trí không chỉ cá cược thể thao hay game đổi thưởng. Nhà cái Five88 còn có loại hình giải trí thân thuộc với người dân Việt Nam khác, đó là game đánh bài đổi tiền thật. Với kho game bài đa dạng trên Five88, quý khách hàng có thể lựa chọn bài “tủ” của mình để chiến với các người chơi bài khác để giành chiến thắng. Phần thưởng sẽ được quy đổi 1:1 khi quý khách có nhu cầu rút tiền.

Các game bài hiện có trên nhà cái Five88 live:

- Tiến lên miền nam

- Tiến lên đếm lá

- Mậu binh (Binh xập xám)

- Phỏm

- Sâm lốc

- Xì dách

- Xì tố

- Liêng

- Cát tê (catte)

- Bài cào (cào rùa)

Cùng với các sảnh lắc xí ngầu hay chẵn lẻ như:

- Tài xỉu

- Tài xỉu sicbo (Hot)

- Xóc đĩa

- Bầu cua

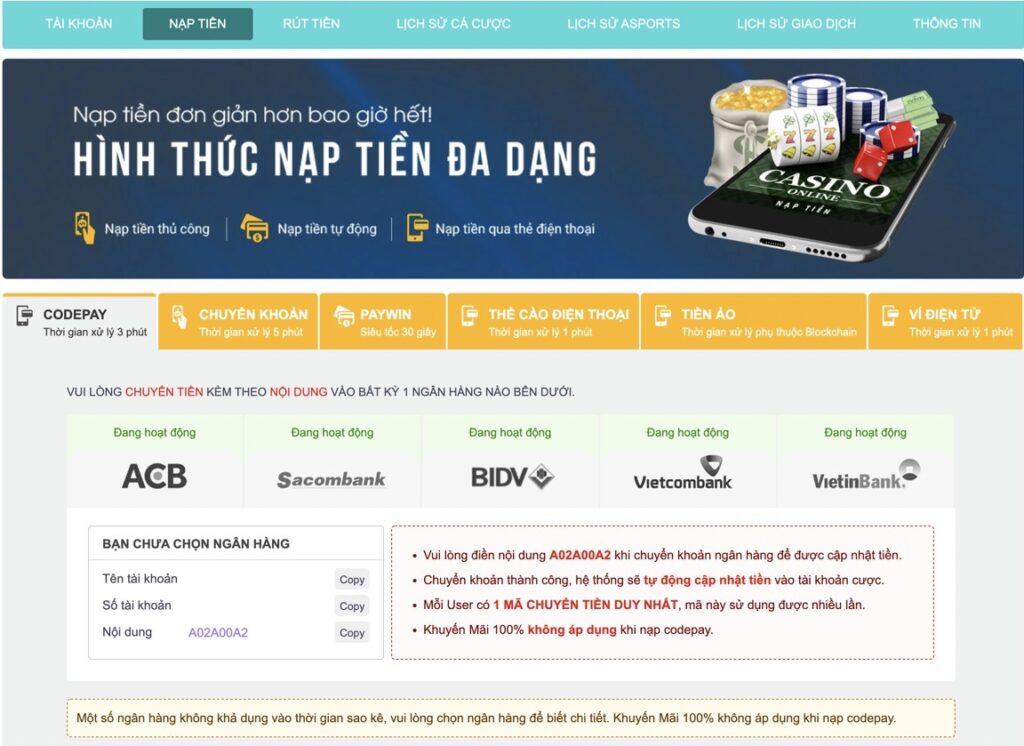

Hệ thống nạp rút tiền siêu tốc tại link Five88

Giao dich nạp tiền siêu tốc

Đánh giá một nhà cái có uy tín hay không thì phần nạp tiền là một điểm đáng chú ý. Đây là phần quan trọng mà bất kỳ anh em nào khi đến với nạp tiền Five 88 hay một nhà cái nào khác cũng phải đặc biệt lưu ý để tránh mất tiền hoặc không nhận được tiền vào tài khoản game.

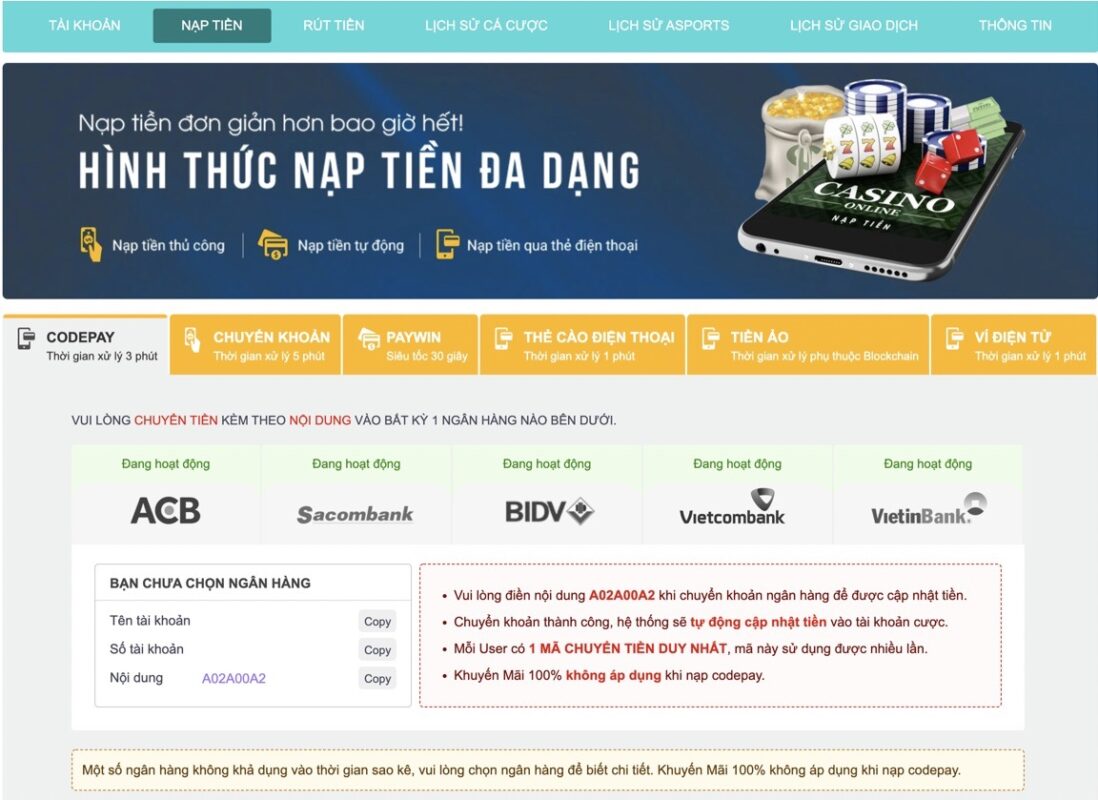

Hiện nay, nhà cái Five88 hỗ trợ người chơi 6 hình thức nạp tiền thông dụng lần lượt là:

- Chuyển khoản

- Code Pay

- FivePay

- Thẻ cào điện thoại

- Tiền ảo

- Ví điện tử: Ví điện tử momo, tiền ảo Bitcoin, Ethereum,…

Với tốc độ nạp trong vòng 5 phút. Cùng với đó là những ngân hàng liên kết và đại lý chất lượng nhất trên thị trường: Vietcombank, Dong A, ACB, Vietinbank, BIDV, Eximbank, TPBank,…

Mà muốn tham gia các trò chơi thì tài khoản của anh em cần sở hữu một khoảng tiền nhất định bằng các bước nạp sau đây.

- Bước 1: Anh em đăng nhập vào tài khoản

- Bước 2: Ở trang chủ chọn phần nạp tiền vào tài khoản

- Bước 3: Chọn cách thức nạp tiền mà anh em sử dụng

- Bước 4: Thực hiện theo hướng dẫn của từng cách nạp cụ thể tại Five88 và tiến hành xác nhận.

Tuy mỗi phương pháp có cách thực hiện nạp tiền khác nhau, nhưng với hệ thống thông minh và thời gian xử lý giao dịch nhanh chóng anh em chỉ mất từ vài giây đến 5 phút là giao dịch có thể được hoàn tất.

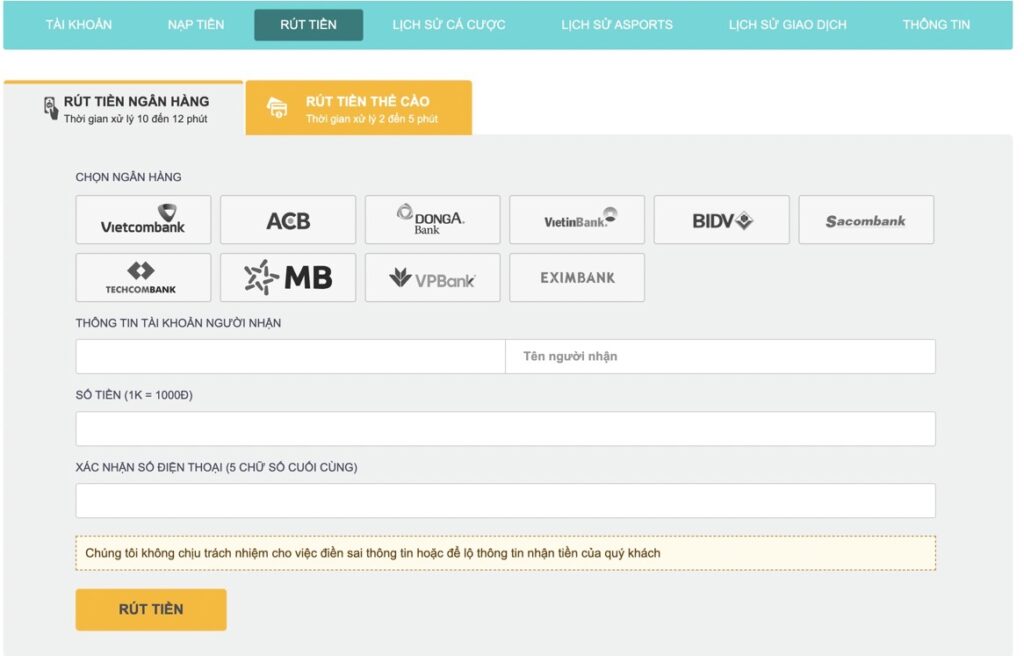

Giao dịch rút tiền trong 3 phút

Rút tiền tại Five88 com là khâu khách hàng cực kỳ thích tại đây. Thực hiện rút tiền trên Five88 chỉ trong vòng 3-5 phút là tiền đã về tài khoản ngân hàngcủa bạn rồi. Tại phần rút tiền Five88, người chơi có thể thực hiện thao tác này thông qua hai hình thức chính lần lượt là:

- Rút thông qua ngân hàng

- Rút thông qua thẻ cào

Các bước rút tiền được thực hiện vô cùng đơn giản như sau:

- Bước 1: Anh em đăng nhập vào tài khoản

- Bước 2: Ở trang chủ chọn phần giao dịch và sau đó nhấn vào phần rút tiền.

- Bước 3:

- Đối với rút qua ngân hàng anh em nhập đầy đủ: Tên người nhận, số tài khoản, số tiền, chọn ngân hàng, xác nhận số điện thoại và nhấn vào nút rút tiền.

- Đối với rút qua thẻ cào: Anh em chọn loại thẻ, mệnh giá, số lượng và xác nhận số điện thoại sau đó nhấn vào nút rút tiền.

- Ngoài ra ở phần giao dịch của tại link Five88 , anh em còn có thể thao tác ở các phần khác như: xem ví tài khoản, xem lại lịch sử cá cược, lịch sử giao dịch và thông tin giao dịch của tài khoản.

Xem thêm chi tiết về nạp rút tiền siêu nhanh tại Five88: https://irnglobal.com/rut-nap-five88/

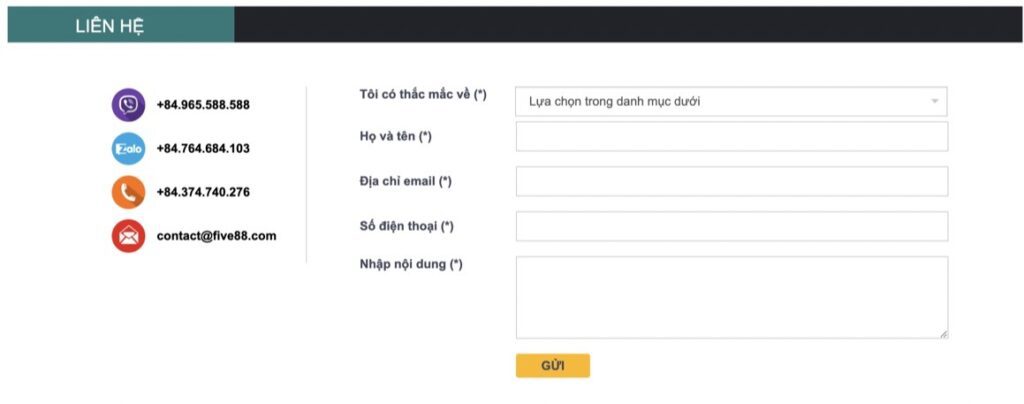

Hệ thống chăm sóc khách hàng 24/7 tận tâm

Hệ thống hỗ trợ của khi đăng nhập Five88 có chất lượng nằm ở mức tốt nhất thị trường hiện nay, với nhiều đặc điểm mà các nhà cái khác cũng phải học hỏi như:

-

- Đội ngũ hỗ trợ chuyên nghiệp làm việc 24/7

- Nhanh chóng giải quyết vấn đề cho người chơi

- Đảm bảo mang đến với người chơi những thông tin nóng hổi từ trang chủ Five88

- Nhiều phương thức lựa chọn cho quý khách hàng để liên hệ Five88 live nhanh nhất hiện nay:

- Hotline: +84.0374.740.276

- Skype: +84.764.684.103

- Viber: +84.965.588.588

- Email: contact@five88.com

Đặc biệt, anh em có hẳn một trang riêng để gửi feedback cho đội ngũ quản lý của web nhà cái m Five88 nếu như anh em gặp phải vấn đề trong quá trình tham gia hoặc có đóng góp cải tiến cho hệ thống của website.

Thành lập đầu những năm 2017, nhà cái FIVE88 là một trong những nhà cái đi đầu ngành giải trí cá cược trực tuyến trong thời kỳ đầu tại châu Á. FIVE88.me đã chuyển sang Five88.win bóng đá với thâm niên hơn 7 năm lâu đời cùng với sự chuyên nghiệp không chỉ nhận được sự đánh giá cao từ phía cộng đồng người chơi mà nhà cái trực tuyến còn là một trong những hình thức giải trí hấp dẫn nhất hiện nay với số lượng người chơi tham gia đông đảo.

Trong bài viết này, các bạn sẽ biết những sự thật thú vị về nhà cái Five88 2023:

- Five88 là ai?

- Five88 đăng nhập có khó khăn không?

- Five88 trực tiếp có những gì?

- Liên hệ tổng đài Five88 qua những phương pháp nào?

- Game Five88 có gì thú vị?

- Five88 bị chặn?

- Five88 có hợp pháp không?

Tất cả sự thật thú vị trên sẽ gói gọn trong bài viết dưới đây, nào hãy cùng Five88bet.com tìm hiểu những vấn đề này nhé!

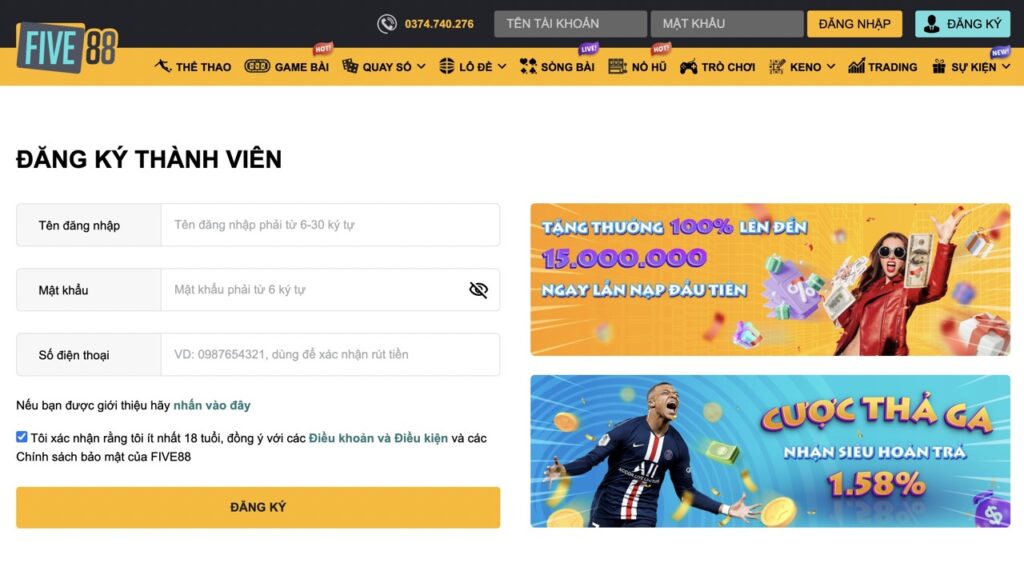

Hướng dẫn người mới tham gia cá cược tại Five88

Để giảm thiểu lỗi và thời gian cho anh em mới vào chơi, Five88 trực tiếp hướng dẫn anh em các thao tác cơ bản để có thể làm quen với giao diện cũng như cách chơi tại nhà cái Five88. Nếu như anh em đang có nhu cầu giải trí tại nhà cái thì mời anh em xem qua cách thức đăng nhập và đăng ký tại đây vô cùng đơn giản tại nhà cái trực tuyến này nhé qua hướng dẫn cách tham gia Five88.

Truy cập dễ dàng vào trang chủ FIVE88

Hiện nay, nha cai Five88 hỗ trợ anh em tham gia bằng nhiều thiết bị thông minh khác vô cùng tiện lợi, chính vì thế mà anh em có thể giải trí tại bất kỳ đâu, bất kỳ lúc nào chỉ với các bước sau:

- Bước 1: Sử dụng thiết bị bất kỳ như điện thoại, máy tính, laptop,…được kết nối với internet ( giao diện trên điện thoại được thu gọn và tối ưu tốt không kém gì so với máy tính )

- Bước 2: Được cấp phép hoạt động chính thức thế nên vào Five88 trực tiếp không bị chặn bởi bất kỳ trình duyệt nào, vì vậy anh em có thể dễ dàng tìm kiếm nhà cái này từ google hoặc cốc cốc bằng cách nhấn vào ô tìm kiếm nội dung “Five88” hoặc “nhà cái Five88”

- Bước 3: Nhấn vào kết quả đầu tiên được hiển thị anh em sẽ có thể tiến vào trang chủ và thấy ngay các trò chơi hấp dẫn tại nhà cái này.

Đăng ký thành viên mới nhận ngay khuyến mãi từ Five88

Việc sở hữu một tài khoản không chỉ giúp cho anh em có thể tham gia vào các trò chơi mà còn giúp cho anh em không bỏ lỡ các ưu đãi hấp dẫn của nhà cái này cùng các phần thưởng giá trị được phát định kỳ.

Cụ thể thì tại nhà cái cá cược thể thao chất lượng m Five88 anh em chỉ cần cung cấp một số thông tin cơ bản trong quá trình tạo tài khoản như: Tên đăng nhập Five88, mật khẩu và số điện thoại cá nhân.

Nếu như thông tin hợp lệ, anh em chỉ mất có vài giây là nhận được thông báo tạo tài khoản thành công và hệ thống sẽ tự động load vào với tài khoản này của anh em.

Xem thêm chi tiết cách đăng ký thành viên Five88: https://irnglobal.com/dang-ky-five88/

Câu hỏi thường gặp tại Five88

#1 Chơi cá cược tại Five88 có vi phạm pháp luật không?

Đáp: Không. Sản phẩm game đổi thưởng trên Five88 mang tính chất giải trực tuyến nên hoàn toàn không vi phạm pháp luật.

#2 Five88 có đua chó không?

Đáp: Hiện tại tính năng đua chó chưa được cập nhật tại nhà cái Five88.

#3 Tôi bị mất mật khẩu phải làm sao?

Đáp: Khi mất mật khẩu bạn hãy liên hệ bộ phận chăm sóc khách hàng để được hỗ trợ lấy lại mật khẩu. Các cách liên hệ tổng đài Five88 như sau:

- Hotline: +84.0374.740.276

- Skype: +84.764.684.103

- Viber: +84.965.588.588

- Email: contact@five88.com

#4 Tôi thắng cược có rút tiền được không?

Đáp: Được. Mọi tiền đổi thưởng cược nhờ thắng cược hợp lệ đều là của khách hàng, Five88 có trách nhiệm chi trả khi khách hàng có yêu cầu rút tiền đổi thưởng.

#5 Cá cược trực tuyến trên Five88 đều ghi hình trước phải không?

Đáp: Hoàn toàn không. Mọi hoạt động giải trí trực tuyến tại nhà cái Five88 là livestream trực tiếp sự kiện diễn ra tại đúng thời điểm đó, hoàn toàn không có sự sắp đặt ghi hình trước để trục lợi khách hàng. Mọi trận đấu và tỷ số đều mang tính chất thực tế diễn ra đúng quá trình đang thi đấu. Nên khách hàng hoàn toàn có thể an tâm khi chơi giải trí tại nhà cái chúng tôi.

#6 Sao tôi không vào nhà cái Five88 được nữa? (update 11/2024)

Đáp: Hiện tại nhà cái Five88 trực tiếp đã chuyển domain từ five88.me sang five88.biz để phục vụ khách hàng tốt hơn. Truy cập nhà cái Five88 mới tại đây: https://five88.biz