12/10/2014 08:59 -0500

Readers are familiar with the fable of “The Goose That Laid The Golden Eggs”, or at very least, are familiar with the metaphor which was the moral of that fable: one should never kill a goose that lays golden eggs. Such advice seems obvious to the point of being simplistic, and yet it is wisdom which has not merely survived, but has been enshrined in the form of a fable.

This is advice which people needed (and need) to hear. Why is this? Because, perversely, any of our species ever fortunate enough to possess such a wondrous bird always ends up killing it. This road-to-ruin is a familiar one, and is best illustrated through providing real-world examples.

The cabal of Western mega-banks previously defined (through research and economic modeling) as the One Bank has several geese-that-lay-golden-eggs. But arguably none of these other fowl deliver a bounty equal to that produced through its debt-slavery: first seducing our Puppet Politicians into accumulating too much debt, and then relentlessly blood-sucking our nations via (compounding) interest payments.

Paradoxically, this Goose is not merely the one which delivers the greatest riches, year after year; it is the Goose upon which all of the One Bank’s other golden geese depend for their survival. Here, translating metaphor to real life is obvious. Killing the “goose” of Western bond debt (and the usurious interest payments which accompany that debt) will occur when this collection of Deadbeat Debtors defaults on these gigantic debts – like a chain of rotten dominoes.

Because the “golden eggs” laid by the One Bank’s golden geese are not made of real gold, but rather are made of paper; when the paper financial foundations of our nations collapse, most (if not all) of these other, paper geese will die alongside of ‘Mother Goose’. This process of self-destruction is made all the more fatalistically ironic when we examine how our governments allowed themselves to be so enslaved to the One Bank.

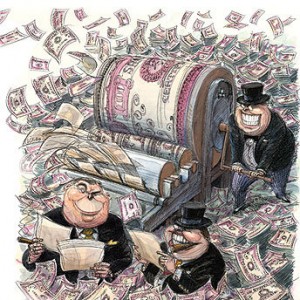

In Machiavellian fashion; the One Bank enslaved Western nations in debt through getting each of them to use their own Golden Goose too often – much, much too often. Astute readers will immediately be able to identify this other, metaphorical goose as the printing presses possessed by the U.S./UK/Canada and (collectively) European nations.

Those with a sophisticated understanding of our monetary system will already know that our (now worthless) paper currencies are literally borrowed into existence.

When our central banks “print” these currencies – in what is now primarily a virtual/electronic process – our own governments must borrow this paper from the cabal of private banks to whom we handed this monopoly.

The primary reason why Western governments are drowning in debt today is not (as reported in the mythology of the Corporate media) through “too much spending”, but rather it was merely the mechanism of currency-creation itself (at a grossly excessive rate) which has cumulatively buried our nations. Here irony gives way to yet more irony.

Why is it necessary for our governments to borrow their own, national currencies, in the first place? Because when the same cabal of bankers enticed/deceived our governments into discarding the last remnants of our gold standard; this process of borrowing money into existence was the only way to impute any value into this paper – beyond the mere decree of our governments.

A gold-backed currency requires no such financial chicanery. Such currency is real money, and thus (by definition) these currency-units are units of value. Fiat currencies, on the other hand, possess no similar virtue of value. Backed by nothing (directly); the intrinsic value of such scraps of paper is literally no more than that of the paper itself.

Thus fiat currencies require indirect backing of some nature, in order to retain quasi-legitimacy, and thus crumble-to-zero more slowly (the ultimate fate of all fiat currencies). How did the One Bank dupe our governments into creating indirect backing for all this fiat-paper? Through borrowing this currency into existence.

While no fiat currency can ever be a “unit of value”; our currency-units are now actually instruments of debt. By borrowing all of these trillions of dollars/euros/pounds into existence; our fiat paper currencies became units of obligation – mini “IOU’s” which derived their value from the implicit promise to make good on these units of obligation through the revenues of our public treasuries.

Indeed; it is precisely through examining this conundrum of creating and maintaining (or rather attempting to maintain) “value” in paper currencies which have no value that we see how/why all fiat-paper currencies must eventually collapse into worthlessness (i.e. hyperinflation). We can see this by merely looking at an alternate reality: one in which our governments never began this (usurious) money-creation-via-debt foisted upon us by the One Bank.

In such a world; we would have paper currencies which had no direct or indirect value of any kind, and where there were no limitations of any kind on the capacity of our governments to create more and more of this paper. In our present world, our own governments’ Golden Geese have debt attached to each-and-every one of the “golden eggs” which emerge from their printing presses. It is this reality which provides the only financial constraint/restraint in this process of paper-printing.

If our governments created too much paper too fast (which, in fact, is precisely what they eventually did); excessive money-creation would/could/must kill their Golden Geese. Imagine a world where these same governments had no constraints of any kind on how much of these paper currencies they could create. Now try to do so without shuddering.

Clearly, any government reckless enough to destroy itself simply through printing too much fiat paper (knowing there was debt attached) would print that same paper at a much more reckless rate if there were no (visible) repercussions/consequences of any kind. Indeed, this is precisely what we now see with “quantitative easing”. And as soon as one government ratcheted-up its printing press, producing infinite amounts of their own ‘free money’, other governments would follow: the monetary disease known as “competitive devaluation”.

Obviously, the One Bank has deliberately and maliciously accelerated our process of economic suicide via fiat currencies, being the prime beneficiary/parasite of this process of self-destruction. But what must be clearly pointed out here – to hopefully avoid replicating this suicide in the future – is that the process of suicide-via-fiat-currencies is inevitable. It is as inevitable as our own compulsion (through greed) to kill any/all geese which lay golden eggs.

The moral of our story is identical to the moral of the fable. Being lowly mortals; we can never be trusted to manage a financial windfall of potentially endless/infinite proportion without abusing such a privilege. The moral of “The Goose That Laid The Golden Eggs” is just one of the arguments which underpins the necessity of a (hard) gold standard.

There is only one way for us to get off this suicide-roller coaster of fiat currencies: avoid them completely. Is a gold standard “perfect”? No. It’s simply the only form of monetary system which we have ever been able to devise which was not/is not inherently self-destructive.