Press the “Refresh” button on your browser while holding down the <ctrl> key to refresh this page.

![Live 24 hours gold chart [Kitco Inc.]](http://www.kitco.com/images/live/gold.gif) |

Silver is the new Gamestop: Price boosted by online movement

Monday, February 08, 2021 by: News Editors

Tags: asset protection, assets, GameStop, investment, Precious Metals, Reddit, risk, silver, silversqueeze, WallStreetBets

(Natural News) The price of silver is rallying as the online trading movement fueling the rise of unloved shares like GameStop took a shine to the precious metal.

(Article republished from HeadlineUSA.com)

Silver futures jumped 11% on Monday to about $30 per ounce – an eight-year high – following strong gains over the weekend.

On Twitter, #silversqueeze was trending as investors turned their attention to the latest market strategy to emerge from the “WallStreetBets” forum on Reddit.

As we kickoff the week, the price of silver is soaring today as the shorts are being squeezed and a $50 price target was just issued, but look at this surprise.

…this is still the early stage of a new gold cycle that started in 2016 rather than the end of it…

“Time to get some payback for the bailouts and manipulation they’ve done for decades…”

#UNRIG VIDEO (29:36) DAVE HODGES INTERVIEWS ROBERT STEELE ON TRUMP TRIUMPHS AGAINST WALL STREET, DEMOCRATS, SATANISTS

Video Message

“Four years ago, we launched a great national effort to rebuild our country, to renew its spirit, and to restore the allegiance of this government to its citizens.

We did what we came here to do—and so much more.”

President Trump’s Farewell Address: https://t.co/bW2jFTngy5

-

UK to Capture £800 Million More in Dormant Assets

The UK government on Saturday announced an expansion to a scheme that captures dormant assets, in order to raise an estimated £800 million ($1.09 billion) that it says will help boost …

Deutsche Bank Pays $100MM To Resolve Chinese Bribery Scandal

For a minute there, it looked like Goldman Sachs might steal Deutsche Bank’s crown as the most felonious bank on Wall Street. The massive penalty Goldman paid to resolve criminal proceedings tied to its role in helping a gang of corrupt plutocrats ransack a public development fund erased the fruits of a “blockbuster” quarter.

But out of nowhere, it looks like Deutsche Bank, which racked up more than $20BN in fines in the decade after the financial crisis, has emerged to defend its throne. To wit, the New York Times reported Friday that Deutsche Bank is expected to shell out $100MM to settle criminal charges that the bank bribed Chinese officials for business in the country. Bribing foreign officials to win business or access is a blatant violation of the Foreign Corrupt Practices Act.

The NYT added that the settlement would be, for Deutsche Bank, the latest black eye tied to its business in China and Russia. Back in 2019, the bank agreed to pay the SEC $16MM to resolve allegations that it bribed officials to win lucrative business deals. It looks like the settlement is tied to an investigation first reported by the NYT back in 2019. In the story, the NYT detailed DB’s long history of lavishing top Chinese political figures and their family members with lavish gifts. As the NYT reported at the time, it was all part of DB’s plan to break into the Chinese market.

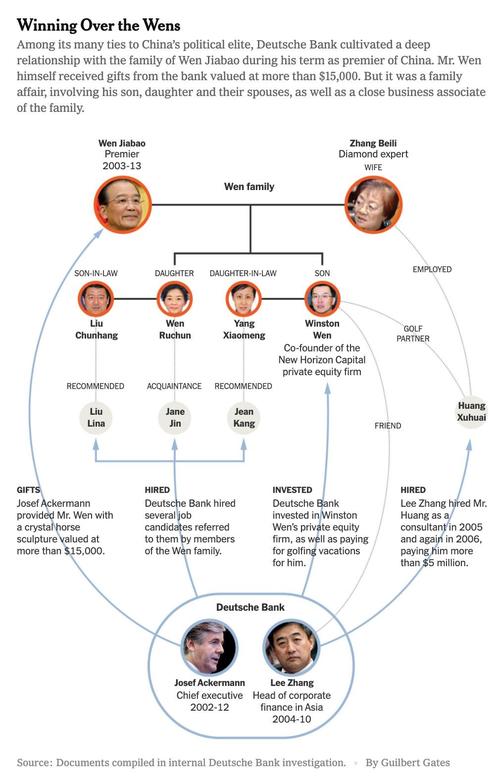

A graphic published by the NYT details the web of top party officials connected to Wen Jiabao, China’s Premier between 2003 and 2013, and his wife and children.

Source: NYT

The lavish gifts included a crystal tiger (modeled after the recipient’s Chinese zodiac sign). For what it’s worth, the bank’s efforts paid off, and by 2011, it had made significant inroads into China.

The bank gave a Chinese president a crystal tiger and a Bang & Olufsen sound system, together worth $18,000. A premier received a $15,000 crystal horse, his Chinese zodiac animal, and his son got $10,000 in golf outings and a trip to Las Vegas. A top state banking official, a son of one of China’s founding fathers, accepted a $4,254 bottle of French wine – Château Lafite Rothschild, vintage 1945, the year he was born

Millions of dollars were paid out to Chinese consultants, including a business partner of the premier’s family and a firm that secured a meeting for the bank’s chief executive with the president. And more than 100 relatives of the Communist Party’s ruling elite were hired for jobs at the bank, even though it had deemed many unqualified.

This was all part of Deutsche Bank’s strategy to become a major player in China, beginning nearly two decades ago when it had virtually no presence there. And it worked. By 2011, the German company would be ranked by Bloomberg as the top bank for managing initial public offerings in China and elsewhere in Asia, outside Japan.

The NYT connected the strategy of bribing public officials to Josef Ackermann, DB’s longtime CEO, who left the bank in 2012. Ackermann was the mastermind of DB’s push into international markets in the US, Asia and elsewhere. It was this aggressive pursuit of growth at any cost that led the bank to do business with Donald Trump, who still owes DB $300MM tied to his Chicago tower.

Hi Yo Silver Time, As Bull Flag Breakout In Play!

Is a Hi-Yo Silver bullish message about to take place in the short-term?

This chart from Marketsmith.com suggests that a breakout attempt from a bull flag pattern is being attempted.

Since peaking in August of 2020, Silver ETF (SLV) has created a series of lower highs, inside of this four-month falling channel.

House, Senate pass omnibus spending bill

Financial Report

Ep. 2352a – The Economy Continues To Improve, [CB] Pushes Fear (16 min)

https://rumble.com/vbuze5-ep.-2352a-the-economy-continues-to-improve-cb-pushes-fear.html?mref=9ceev&mc=ewucg

Political/Geopolitical Report

Ep. 2352b – Art Of The Deal, SC Just Gave Trump The Answer, 2018 EO On Deck, Blackout Coming (48 min)

https://rumble.com/vbuzrr-ep.-2352b-art-of-the-deal-sc-just-gave-trump-the-answer-2018-eo-on-deck-bla.html?mref=9ceev&mc=ewucg

Signs, Signs, Everywhere There’s Signs. But

Investors Disregard…

Trump Team Has Dominion Machine— Shows Votes Flipped

-

Husband of Former Amazon.com Finance Manager Pleads Guilty to Insider Trading

The husband of a former Amazon.com Inc finance manager who leaked confidential information about the online retailer’s financial …

Democrat rep. criticizes Pelosi for not accepting GOP stimulus deal

If You Can’t Beat ‘Em, Join ‘Em

Written by Craig Hemke, Sprott Money Ne

Suddenly it seems that nearly all of The Banks and Bullion Banks are raising price forecasts and rallying around the precious metals. Is this a good thing or a bad thing?

That’s the question, of course. Banks like Goldman Sachs have earned a reputation for leading their clients into taking the opposite side of whichever trade the firm prefers. If you’ve forgotten the origin of this story, here’s a link from 2012:

It has been long established that the major Banks, which also operate as Bullion Banks for the CME/LBMA, benefit handsomely by manipulating and managing the prices of gold and silver. Recently, however, there have been a spate of admissions and convictions as it relates to these criminal activities. A summary can be found here:

So when you read below of all the recent Bank analyst “upgrades” for gold and silver, what are you to make of them? Is this a BAD sign…where The Banks are simply luring everyone they can persuade onto the wrong side of the boat? Or is this a GOOD sign…where The Banks are finally understanding and admitting that their days as Market Manipulators are coming to a close, so they might as well start moving themselves and their clients to the long side?

At the risk of sounding hopelessly naive, I believe it’s the latter.

Why?

Because just about anyone can see that we stand at the doorstep of an epochal change in the global monetary system. The Great Keynesian Experiment is failing, as the monetary growth needed to service the existing global debt is finally exceeding the capacity of the system to provide for itself. Put another way, the global central banks are now permanently in a mode where only the continual and rapid creation of additional fiat currency can feed The Beast of exponential debt.

Chairman Powell has said as much in his recent public appearances, where he has been practically begging the U.S. Congress to give him more treasury debt to monetize. Lagarde of the ECB finds herself in the same position, and the Swiss National Bank is now, for all intents and purposes, one of the largest equity hedge funds in the world.

And that new debt is coming, too. In response to The Covid Crisis, the U.S. posted a mind-blowing $3.2 TRILLION deficit in the fiscal year that ended on September 30. If President Trump wins re-election in two weeks, expect a similar shortfall in fiscal 2021. If Joe Biden wins, additional spending programs may take the deficit to $5 TRILLION and beyond.

As a precious metals investor, you already know this. Now The Banks are finally catching on, too, and they are beginning to recognize that any prudent investor must have at least some precious metal exposure. To wit, here are just a few of the recent headlines and “upgrades” from the major Banks:

- Bank of America gold: Gold price to surge past $3,000 says Bank of America

- Goldman Sachs gold: Goldman Sachs says gold will surge another 20% and hit $2,300 in the next year, driven by rock-bottom interest rates

- Morgan Stanley gold: Could Investing in Gold Add a New Dimension to Your Portfolio?

- UBS gold: UBS ‘very bullish’ on gold as bank expects bullion price to surge higher

- Goldman Sachs silver: Silver to Benefit From Global Solar Surge. It’s Time to Buy Again, Goldman Sachs Says.

- Bank of America silver: Biden’s ‘green stimulus’ would send silver soaring to $50: Bank of America

- Citigroup silver: Silver Institute Tweet

About the only Bank that’s NOT excited by the prospects for gold and silver is JP Morgan. Big shock there, huh?

So we’ll keep an eye on this in the months ahead. Could there be a battle brewing amongst The Banks? Maybe. And if it plays out that way, which side “wins” will go a long way toward determining whether gold and silver will finally break free of the shackles imposed by The Banks’ fractional reserve and digital derivative pricing scheme.

If You Can’t Beat ‘Em, Join ‘Em

The Backlash Against The [CB]s Has Begun, Trump Prepared The US In Advance – Episode 2305a

UPDATED: INVESTMENTS – GOLD, SILVER, RIPPLE (XRP)

UPDATED: 13OCT20

The new global financial system is being built right in front of our eyes over the last couple of weeks! We are about to see the greatest transfer of wealth the world has ever seen!

This is a financial paradigm shift of epic proportions! We are about to see a wealth transfer unlike anything we have ever seen before! You are positioned on the right side of history! Massive surprise coming in the next few weeks!!

NEW INFO:

Quantum Financial System has been turned on at ~2:30am 7OCT20 Perth Time

Apple announced partnership with Ripple!

Ripple got the Patent for Smart Contracts using Ethereum and Flare!

MASTERCARD have now come onboard the XRP network!

The rockets are launching the Quantum Internet and Quantum Financial System infrastrcuture.

Massive amount of banks closing due to “COVID”

In August 2020 there were 6088 Cryptocurrencies. It has been said that only 1% or maybe even less will survive. The key to them is regulation. ISO20022 is the main regulation. INTERNATIONAL STANDARDS ORGANISATION. Everything will need to be ISO Compliant. = $XRP $XLM $XDC $ALGO (FLARE TNG TURING), IOTA (QFS also backed by precious metals)Others are TC 68, TC 307 & TR 23455.

China will be huge for us, 1 billion digital currency users! India has a billion digital currency users signing onto XRP too. Latin America and now Africa have just announced that they are signing on too!

The new BASEL IV banking rules require ISO22002. XRP is the only cypto currency that has conformed to this standard. What is unique about XRP is that it allows for a comment field to be atteched to every transaction and that it has end point verification on the transfer before it is sent. Meaning, it verifies how much will be received at the end point before it sends the XRP. This prevents any transaction from being stolen or rerouted in transit.

NEW intel is that XRP will be announced on the 10th of Sept 2020. That will raise the price to USD$50 in 24 hours.

Rocket launch for the controller sattelite for the new Quantum Financial Sytem has been delayed until 3 Sept 8:24am Us time.

XRP is like the new bitcoin except it has enormous utility value and massive client adoption. China, india and latin america, visa, american express, applepay, googlepay, samsungpay, ethereum all banks and 196 currencies have all signed on to the XRP network! the value of xrp is based on the number of transactions running through the network, so the only way for it to go down is for us to stop using our credit cards or world trade to crease. china and india have 1 billion digital currency users who will be linked into the XRP system! This is advanced computer technology that can take us through the next 1000 years of peace!

This is fabulous computer technology for our star trek future!

Nothing in history has ever or will ever come close to the profits that will be made from XRP!! ..and it is honest money, not criminal or exploitative money! It has integrity and self empowerment!

The NESARA/GESARA money and the $Trillion American stimulus money running through the XRP network will so increase the transaction rate through the network to such an extent that we might see a $10,000 XRP coin in as little as 2 years!!

There is no other competitor for XRP. XRP is the only crypto that conforms to the new Banking Standard ISO22002, which is requirement of the new international banking rules. It is the only crypto able to include a comment field with every transaction and does start point to end point verification before of the amount before the transaction is sent! You can know how much is ending up at the end point of the transaction before you send it. This verifies the transaction before it is sent! It is transparent and reliable banking

The price of XRP has gone down due to the testing being finalised. They are preparing for the next move, which is that all of the $5T of SWIFT transactions to be routed through the XRP network on1st sept. That is when we will see the price rise dramatically!

The SWIFT system will be turned off on the 31st August 2020 and all $5T of daily transactions will be routed through the Ripple(XRP) system on the 1st of Sept 2020 sending the price of XRP to USD$50 in 24 hours! XRP is the new Quantum Financial System for global finance!

Ripples own digital wallet is called XUMM. It is very security intensive to set up by would be the safest digital wallet to store your XRP in if you done have 2 factor authenication with your trader.

XRP is 57,000 times more environmentally friendly than Bitcoin and Ethereum.

XRP went live on 2nd of August and pinged every bank in the world! It will run parrallel with the current system for a few weeks!

XRP is a sustainable currency, a green alternative to Bitcoin. XRP is bridging digital divides, mobilising private capital and connecting Asia to the rest of the world.

These price swings are nothing! The recent market volatility was expected as the announcement gets nearer and the repo stimulus ends. We are pivoting from the old system to the new gold backed system. We just have to ride it out as the market changes over to the new Quantum Financial System (Ripple(XRP)) and then reap the rewards!!

A new asset class is being created around the world allowing crypto currencies to be held by the banks as an asset. This means that you can store your coins as an asset like a house and borrow against them without ever having to sell them! They would continue to appreciate as more and more transactions go through the Ripple(XRP) system daily!

It is looking like some financial event will happen on Sunday 2nd August 2020, maybe the announcement that Ripple(XRP) will be the new Global Quantum Financial System! Full Moon too!

ApplePay, GooglePay and VISA have announced that they have signed onto Ripple(XRP).

Ripple will get to $10k per coin when the daily transactions reach $1T by transacting “All the Money in the World!” once it is adopted by the global banking system!

There are currently no projections that Ripple(XRP) will fail, only contention is how much it will rise! The minimum projection is that it will be $1.60 by the end of the year! $10K in 5-10 years or sooner!

Your ripple account is like a bank account in that you can take money in and out with only a small fee of 1%, but the profits could be enormous!

Ripple allows On Demand Liquidity which saves the banks a fortune and eliminates their exposure to currency price risks! It means that the banks don’t have to hold every currency, they just have to use XRP!

Treasury will shutdown on 25th July to implement Ripple (XRP)? “It can be done in a day”

Judy Shelton has been approved as the new FED board member by the Senate Banking Committee! She is a staunch supporter of the Sound Money Principle (Gold Backed) and has talked about the a crypto- currency being a part of that principle. She is the architect of the FED restructure into the treasury and will be the new chairman when Powell goes.

Paypal to use Etherium for it’s 325 million users. Etherium has connect to Ripple!

Gold-backed currencies are coming!

The paper contracts are running out and are not being renewed. Gold and silver will move to their historical values or more. Gold is traditionally priced at $10k-12k and silver to gold ratio is traditionally 47:1. The ratio of gold to silver now is close to 100:1. This will balance itself and generate a profit from gold of ~5x and from silver ~10x.

You can guarantee your profits by buying silver as well. Silver will go from $23 per oz to $3-4k per oz as soon as the gold backed currencies are declared.

Silver is used in everything, electronics, phones, cars, water purifiers… It is very hard to mine and there is no reason it should be so cheap and undervalued. It is starting to break out now. As soon as the gold backed currencies are announced, it will go to its traditional price.

It has been announced that Ripple(XRP) will be the new method for transferring money between countries by the 196 central banks worldwide and will be gold backed. It has all the latest tech built into it and will be used when SWIFT is discontinued on July 21 2020 because of it’s criminality, dishonesty and it is archaic technology! It should be announced any day now and go up to $50 per coin overnight.

Bitcoin was invented by the Queen to run her Pedo operations worldwide. This pedo coin will disappear when the public finds out along with all the other coins that are backed by nothing as they are in the simplest of terms, just a computer game compared to a gold backed solution. Putin has rejected Ethereum, so that will not be used by the central banking countries. The Chinese have shown themselves to be a corrupt killing machine, so nobody will use their solution. Ripple is the only viable solution for transfers between countries that is available now.

I believe that Ripple will end up linking directly to our credit cards to replace the banking systems entirely. ..and it is!

Qanons is being told something with these numbers (17 and 1776) that only we would recognise. I believe that Q+ is rewarding our support.

I have taken holdings in gold, silver and Ripple (XRP). The profits from gold and silver are guaranteed and will easily cover the loses from Ripple if it fails to go off.. But, if Ripple(XRP) does go off, the profits from it could make the gold and silver profits seem very small!

The 2nd stimulus is going to be rolled out in America via XRP!

This link will get you an extra 10 worth of bitcoin to swap to ripple https://www.coinspot.com.au/join/REFD9JQWU in Australia or crypto.com app in other countries.

Silver can still be ordered here www.abcbullion.com.au in Australia.

““XRP will be on the center of all of this as they have laid the foundation of talking to banks and marketing the wonders of XRP for quite sometime now. In fact they have already gone past the testing phase of the technology and have successfully shown how fast, and cost effective using XRP is without compromising scalability.”“

“$10,000 is not impossible now because Bitcoin reached $20,000. When $20,000 was hit by Bitcoin this sort of gave us a subliminal message on how high a crypto can go, and so now people have this notion that $10,000 is possible.”

All of these articles can be found on my facebook page https://www.facebook.com/brhyland/

Send me a message and I will friend you!

When it is announced officially, we will hear about it on mainstream media. That is when the big institutional groups are allowed to buy in. At the moment, they are restrained from purchasing due to NDA’s and the threat that they will be excluded from the entire new financial system if they do the wrong thing. That is why and when it will go to $50 per coin.

The value of the coin is based on the number of transactions going through the system. At $51 per coin, the system changes in a way that won’t be allowed initially, something to do with market cap. So it will cap at $50 for a short time until the system has stabilised and the predatory investors have been removed from the market, then it will be allowed to go up to the moon or higher(IMHO)!

It is an amazing feeling to have a physical metal asset, rather than digital or paper money. It did something to me! I felt very different after i laid on my bed with a bar of silver in each hand. Something of an electrical nature happened in my core and I could feel it changing me inside. Silver is a highly spiritual, feminine metal and is well worth the experience of owning it. Gold is a masculine metal

After WHO Flip Flop, Former FDA Chief Says No Reason For Another Round Of Lockdowns In US

The Hazards Of 4 More Years Of Jerome Powell

Former Deutsche Bank Traders Convicted Of Fraud For Spoofing Precious Metals Between 2008 And 2013

Former Deutsche Bank AG traders Cedric Chanu and James Vorley were convicted for manipulating gold and silver prices on Friday after three days of deliberation by a Federal jury in Chicago.

The two were accused of making fake trade orders between 2008 and 2013 to influence the prices of precious metals. Their trial was a week long and was the first of its kind since 2010, according to Bloomberg.

The convictions come as the result of a crackdown on “spoofing”, placing orders with no intention of executing them, in order to move the price of the underlying product. Spoofing works by fooling the market into thinking there are more bids or offers than are legitimately there. It has been illegal since 2010’s Dodd-Frank act.

Chanu and Vorley were said to have “weaponized” this tactic to mislead other traders, according to prosecutor Brian Young. The traders knew what they were doing, the prosecution argued, with Vorley even writing in a message to Chanu at one point: “This spoofing is annoying me. It’s illegal for a start.”

A co-worker at Deutsche Bank acted as witness during the trial and told the jury that Chanu and Vorley taught him how to manipulate prices by spoofing. The defendants didn’t call any witnesses but instead raised the issue of how difficult it was to try and prove criminal intent for “spoofing” in competitive global markets.

“If you fake a pass and run the ball, that’s competition, not fraud,” Vorley’s lawyer said.

Chanu was convicted on seven counts of fraud and Vorley was convicted of three counts. They were found not guilty on charges of conspiracy. The government has said they are going to seek about four or five years of jail for each person. Vorley said he will appeal and that he was trading “well within the law”.

Vorley’s lawyer said: “It was a compromise verdict by a jury that three times declared it was deadlocked, deliberating in the face of a Covid scare. The record is clear there was no fraud. The compromise conviction will not stand.”